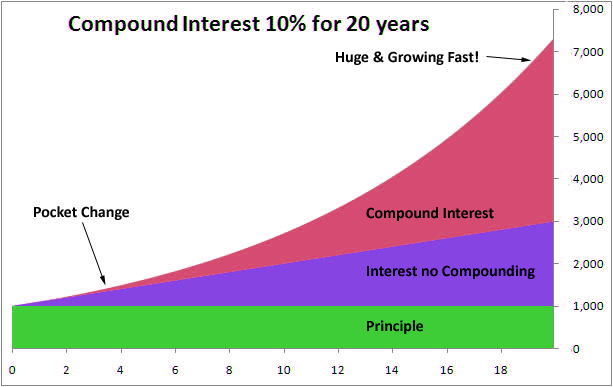

In the life of any person, figures call it numbers are the most essential. For every investment with figures attached to its vision and mission, his success would not be far fetched.When talking about investments, simple interest yield is not as important as compound interest yield. Compound interest being a mathematical wonder, when utilized in investment practice, it turns a negligible small fund into a monumental fortune.

Compound interest is simply interest that is collected both on the principal (the original amount) and the interest that has already been applied to the principal.

This means that each time interest is applied to the amount (also known as being compounded), the amount of interest compounded will be added to the principal for the next time that the interest is compounded. To put it all the more essentially, compound interest implies that each time interest is connected, it is connected based upon the whole sum rather than simply the main.

Since compound interest is connected to the greater part of the cash held inside of the record being compounded, this implies that as time passes by more cash will gather inside of the record on the grounds that every increment will therefore build the sum being paid. This is frequently the case in investment accounts and interest-bearing chequeing records, and additionally with the interest due on numerous advances.

To outwit compound interest, the accessible insignificant little store must be put resources into a benefit yielding endeavor and consistently reinvested with its benefits more than a drawn out stretch of time. Consistency of re-contributing the accessible store is an essential condition to accomplishing any set focus with compound interest. Time, alluding to long stretch of speculation is key if compound interest must get to be pertinent.

Compounding of interest could be accomplished in any given business. In standard speculation, it means steady turn over in deals. Nonetheless, when a standard activity arrangement is situated set up, it makes the projection more achievable.

The following must be clearly set out-

Amount to be investedRegularity of investmentAnnual rate of returnsNumber of years of the investment.

Let’s look at an example, if a 20 years old man has chosen to invest 1,000 Rupees per year for 40 years period at the rate of 15% compound interest, what will he have at the end of his investment?

Yearly investment – 1,000.00

Number of years – 40 years

Annual compounding rate – 15%

Total yield – 17,79,090.31

The above figure looks magical yet realistic. It is achievable.

Only one thing is important towards realizing this figure and its like- long term projection and patience. One must realize that the process is very slow and could be boring yet the finishing turns out great.

Investing with compound interest approach is quite advantageous for the fact that the amount of money to be invested annually is proportionally small and affordable to anyone who opts for it. It could be done personally in an investment or other certified investments. It could be obtained in bonds, certificates of deposits, mutual funds and mortgage financing.

However, many people are not aware of such investment windows due to stereotyped disposition to finance. Also many see it as a lazy vehicle to wealth creation. Lastly only a negligible few can actually do the mathematical computation involved in the business plan.

The Two Levers of Compound Interest: Frequency & Time

1. Recurrence (or Interval)

A few funds and ventures may compound quarterly or even month to month. Thus, its critical to locate this out ahead of time from the monetary establishment or specialist. The recurrence with which returns are compounded is especially vital when putting resources into Bonds. The accompanying demonstrates the distinction in how the equation is figured.

Quarterly Compounding = P (1 + R/4)4Monthly Compounding = P (1 + R/12)12

The more regular the interim of compounding is, the more prominent the effect on compound development. In any case, its important that despite the fact that recurrence is an essential lever in the effect of compounding on the future estimation of an investment funds or venture vehicle, it is not as impactful as the term i.e. timeframe (in addition to the compounding recurrence “lever” is liable to the theory of unavoidable losses after some time).

2. Time (i.e. the Term)

Compounding applies its most sensational impact (for a given interest rate) when the term is broadened. At the end of the day, the more extended a sum is liable to compounding, the more noteworthy the impact.

In the event that you contributed 10,000, utilizing the above recipe, compounding interest at 8% for each annum, more than 10 years just, the future quality would be 12,597. Be that as it may, taking the same main entirety and interest rate, yet compounding more than 25 years, the future quality would be 21,589!

Along these lines, as should be obvious, the impact of term length is exceptional:

the first whole of 10,000 duplicates in under 10 years and increments more than seven fold in 25 years. How to Guarantee You’ll Become a Millionaire, If you are a long haul proselyte to the propensity for sparing and contributing, then you will have undoubtedly found that compound interest is your long haul closest companion making progress toward riches creation.

The best thing about compound interest is that it is your cash working for you instead of the other route round. Pocket change can actually transform into millions more than 20 or 30 years. Did you realize that on the off chance that you contributed just 5,000 every year at a normal return of 7% from the age of 25 you’d be a mogul when you hit 65.

Alright, so swelling would destroy the genuine estimation of those million dollars following 40 years yet it demonstrates the point that after some time, consistent sparing of little sums can develop an amazing entirety of cash. The key to harvesting the advantages of compound interest is:

Sparing and/or Investing a general measure of cash every month. Leaving you cash contributed for the long-term. Reinvesting your additions (interest), over and over.

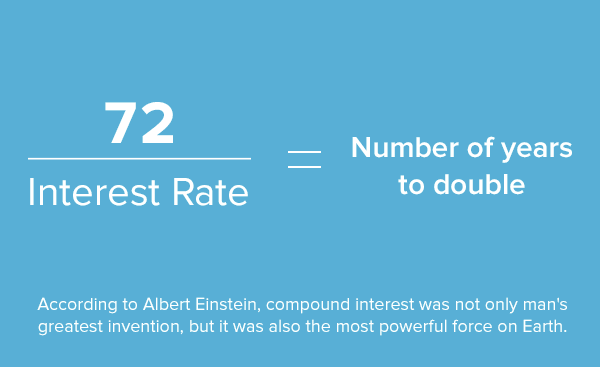

The Rule of 72

Conclusion

Thus, compound interest permits you to get rich gradually after some time however you can accelerate this procedure and get rich snappier by pulling on the two levers of recurrence and time. Obviously, expanding your interest rate by picking the right venture vehicle in the first case is likewise a major variable.

Thus, it is imperative to, as you get your carport of fund prepared, to get that riches working for you, not sitting without moving by, even while you’re sleeping. Compound interest can do that for you.

Exploit the capability of compound interest, and you’ll be well off before you know it! However, the key take-home message in the majority of this is, leaving aside interest rate, the measure of capital (important) you begin with is not about as essential as time i.e. beginning early. Keep in mind, the immense thing about compound development is that this “enchantment recipe” is accessible to EVERYONE i.e. YOU, the day you settle on a choice to use it!

Leave a Reply