In the wake of inflation and economic crises globally, the need for good cannot be stressed. While it is important to keep your finances in check, virtually every single person has a story or two about how difficult it can be to keep your credit in check even for a rainy day.

For most people, keeping their credit afloat has proven to be quite the challenge and before coming to the realization that things are headed south, most of the time the debt margin is usually too big to be recovered in an instance.

Do you know, You can Remove Negative Items From Your Credit Report in

5 Simple Steps, YOURSELF!

A bad credit report can cost you thousands of dollars a year in overpaid interest, or can keep you from being approved for credit altogether. Use the chart below to see how bad credit scores may impact you.

| CREDIT STATUS | RATE | PAYMENT | COST OF BAD CREDIT |

|---|---|---|---|

| Excellent | 3.9% | $1,179.17 | $0.00 |

| Mildly Damaged | 5.0% | $1,342.05 | $58,637 |

| Damaged | 6.3% | $1,547.43 | $132,574 |

There are many companies that offer credit repair services. While most perceive these companies as meagre scams, others have convincing testimonials of the wonders that credit repair companies can do when it comes to getting their customers back on track.

Needless to say, as an individual, it is possible to do your own credit repair, however, certain aspects of doing with customer protection laws might appear to be elusive leaving you in more trouble than before. This is where the experts come in.

Lexington law is one of the companies that have emerged as a force to reckon with when it comes to credit repairs.

This company of credit lawyers has been in practise since 1991 and has recorded tremendous trends in improving the lives of their customer when it comes to giving them good service.

Their timely services have seen many get financial liberation from bankruptcies, tax liens and many other such situations that make people have bad credit.

By virtue of the fact that at Lexington law credit lawyers handle all your credit issues, you can rest assured that when it comes to getting leverage for their customers they are the very best putting consideration the fact that they are the gurus of customer protection laws.

On the other hand, Creditrepair.com is another credit repair company that has been in the picture since 1997.

Creditrepair.com has also emerged as a stronghold in the credit industry and many have their good testimonials about this Washington-based company.

Creditrepair.com has come a long way to providing its customer with service in terms of credit evaluation and management. This includes petitioning and removing unwarranted errors from their credit reports.

The efficiency of this company has seen it gain partnerships with credit report firms such as Equifax increasing accuracy and taking customer satisfaction a notch higher.

While both Lexington law and Creditrepair.com have made milestones in the credit repair industry, there are certain comparable differences that make one company better than the other.

Such differences in terms of customer service, cost and the recovery time determine customer preferences and ultimately the perception of excellence from the view of financial analysts and the customers themselves.

Of the two companies which one is better, one would ask? Without a critical analysis of the various aspects involved in customer service and credit repair, making a rational judgement on which of the two better proves to be a little bit difficult.

How they do it

Both companies have one goal in common, to ensure that each customer gets the best credit reports in the shortest time possible.

Lexington Law takes the legal forefront in getting you the kind of credit that you deserve. By using the consumer rights as a bargaining chip when it comes to validating your credit reports, they ensure that your reports are relevant and substantiated.

This directly translates to the exclusion all errors ensuring that you get the number of removals that you deserve.

While one would argue that this is the approach that is taken by virtually all companies, what gives Lexington Law the upper hand when it comes to credit repair is the vast knowledge of the law by their paralegals, associates and all staff that will be working on helping you achieve your financial goals.

With up to three bureaus to help in reviews of the reports and the validating process in addition to their vast experience over the years, Lexington Law has done reforms in the lives of many with some experiencing up to 10.2 removals within a short period of time.

Based on their performance index, Lexington Law usually gets the job done.

Creditrepair.com has also had a record performance when it comes to removals and giving their clients the very best.

There is a team of financial experts in conjunction with credit bureaus to give their customers the very best of credit repair services.

The main strategy here involves having thorough credit evaluation in order to identify errors and making petitions to the credit companies on behalf of their customers.

In addition to this, Creditrepair.com has also adopted customer education as a strategy to empower their customers to gain independence in terms of financial discipline and change of habits.

To add to their numerous services, Creditrepair.com allows their customers to monitor their recovery process via online portal over 90days.

Needless to say, such has seen Creditrepair.com have contented customer achieving up to 11.6 removals, accounting for 7%, across three bureaus for some of their customers.

To add to the great accounts and records some customers have seen up to 40-point increases in their credit.

While both companies have a good approach to the matter of credit repair, their difference strategies have had little effect on the difference in terms of the performance index.

It is important to note that one person’s story can be synonymous to that of another.

Although the credit recovery is different for both companies this cannot be used as a rule of thumb in determining which of the two is better putting into consideration the fact that the results of the credit repair are determined by the extent of the damage on the individual’s credit.

That aside, there are many factors to consider but when it comes to strategy and execution of their promises to their clients, both have done extremely well over the years and they deserve their ranking among credit companies.

Cost

As you try to salvage your financial situation it is important to note that even the professions who come to your rescue have some fee attached to their services.

The first thing that many customers consider is the cost of procuring the services in the first place.

While many cannot afford the services of credit repair companies it is important to note that the need to evaluate and compare the prices of the various firms is part and parcel of making a financial recovery.

Why pay more for the money that you do not have in the first place?

Lexington Law has been known to offer good packages to suit the needs of their clients.

Their monthly charge for the Concord standard service amounts to $79.95 per month. On the other hand, their Concord premier service amount to $99.95.

The Concord standard service offers the basics in time for ethical issues, advocacy and legal interventions in the entire process of getting your good credit.

The Concord Premier includes additional services such as Transunion credit monitoring, Report watch, Inquiry assistance Monthly credit score analysis and Identity theft insurance.

While both packages offer the basics which narrow down to creditor interventions and debt validation the Concord premier is the better package considering the fact that in addition to the $79.95, in the first month a service fee is included making the total cost of day 5-15 amount to $99.95.

In addition to relatively fair prices by Lexington Law, the 50% couple’s discounts and other family discounts have proven to be lucrative to the various customers.

Putting into consideration the fact that most customers cannot afford such services with bad credits, Lexington Law has a free credit score guide to educate and ensure that either way, the customer makes steps forward when it comes to gaining financial ground.

On the downside, as with many credit companies, Lexington Law does not have a money back guarantee but with every coin that you pay it is indeed value for your money.

Many have pointed out the fact that Creditrepair.com is one of the more costly credit companies. The issue of cost is usually comparative.

While creditrepair.com does not offer a variety of packages for its customers, unlike Lexington Law, the monthly charges narrow down to $89.95 monthly exclusive of a $12.99 service fee during registration.

On the other hand, to add to the perception that Creditrepair.com’s services are costly, rarely do they have family discounts and just like other credit companies, money back is not guaranteed.

On the brighter side with Creditrepair.com, you have the option canceling without incurring any penalties.

Cost is a key determinant when it comes to telling a good credit company from a bad one. It the packages offered by Lexington Law offer flexibility and allow the clients to cut the cloth according to their sizes.

Such options prove lucrative to customers and this is one of the many considerable factors that put Lexington law on the maps when it comes to credit repair.

Time

When it comes to credit repair time is of the essence this stems from the fact that the longer one waits the higher the interested accumulated and the greater the payable debts.

While Creditrepair.com can boast of having achieved close to 40-point credit transformation in a month, the time is taken to have credit recovery entirely depends on the depth of the damage and how soon credit intervention kicks in.

On average, one starts taking note of the changes in about 30-45 days after the process of credit recovery begins.

On average Lexington Law takes 2-4months to have sufficient credit recovery for their customers.

The same value is seen even in the case of Creditrepair.com. Time is a variable that can be used to assess performance and efficiency of the credit repair.

Both Lexington Law and Creditrepair.com get the job done in very good time but the fact that this entirely depends on where your credit score is and where it needs to be cannot be over emphasized.

The amount of time taken to get credit recovery takes us back to strategy and the efficiency of the credit bureaus in validating the credit reports.

By virtue of the fact that both companies work hand in hand with renowned credit bureaus, the recovery time cannot be used to categorically state which of the two is the better one.

Such a judgement based on time can be entirely subject making it necessary for someone to consider other aspects such as cost and how effective the strategies in place are.

Summary

- Price:

- BBB Rating:

- Guarantee?

- Phone Number: call to talk to a live person. from 9 a.m. to 5 p.m. on weekdays.

- Apply: Visit CreditRepair.com website

- Price: Initial fee of $99.95, plus $10 so they can pull your credit reports. After that, it is $59.95 a month for the basic package,

- BBB Rating: NR

- Guarantee? Lexington Law will not charge you until they have completed all the work that they agreed to do. On the downside, it is not a 100% guarantee like Sky Blue’s

- Phone Number: call (844) 259-3376 to talk to a live person. every day from 7 a.m. to 12 midnight.

- Apply: Visit Lexington Law credit Repair website here.

Our Recommendation

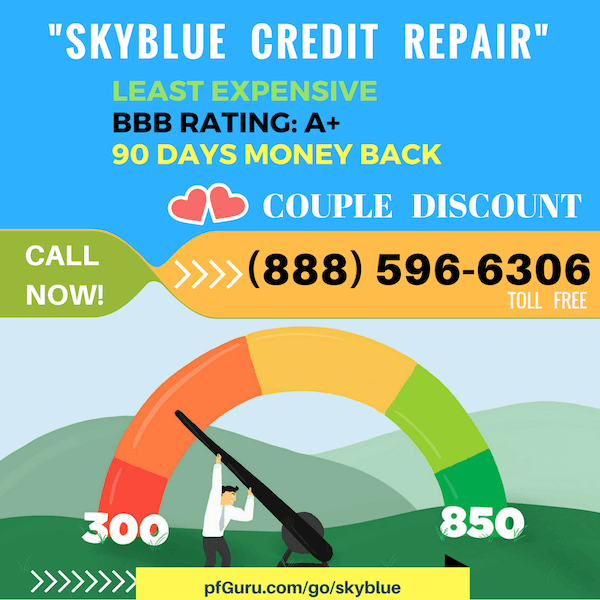

If you want the best service, guaranteed results and cheap price then instead of Lexington law or credit repair go for SkyBlue Credit Repair

- Price: $59 to start,

- BBB Rating: A+

- Guarantee? Sky Blue is one of the only credit repair services that offer a full 90-day refund no matter what the reason.

- Phone Number: call TOLL-FREE No: (888) 596-6306 to talk to a live person. from 9 a.m. to 5 p.m. on weekdays.

- Apply Online: Sign up for Sky Blue here | Sky Blue website

Conclusion

The need to have good credit is fundamental, this goes without saying. Good credit creates an opportunity to grow and to have financial independence.

With good credit you can have your kids go to college, get a mortgage and build a good home and even get a good job. These are just examples of how much you can achieve when you have finances in check.

On the other hand, bad credit is like a chronic disease, without help you will keep getting worse by the day. Bad credit translates to increased cost of living and overpaid interests and this means never getting out of debts.

The need for professional credit repair intervention and enforcements is a single factor that makes the difference between you and the person next door who seems to be ten miles ahead of you.

While a personal debt repayment plan can do wonders for you, what are the odds that you will go in circles and wind up where you started?

Lexington Law is a company that has earned itself a Gold award in terms of credit repair.

Looking at what you can get from these professional credit lawyers, their packages are pocket-friendly and accommodative to everyone.

On the brighter side, you can almost rest assured that the results will happen sooner that you can imagine. Creditrepair.com has also cut a niche for itself among the giants of credit repair.

While their strategy is effective, their cost of services seems to be relatively high considering other companies such as Lexington Law are cheaper and have more to offer.

our recommendation is

However, the decision on which is better is subject to opinion based on your needs. Be the judge.

It’s amazing too pay a visit this web site and eading the views of

all mates concerning this piece of writing, while I am also eager of getting

familiarity.