What will be my source of income after retirement? How will I survive after retirement? These types of questions arises in every individuals mind, sooner or later. Those who works in government / organized sectors can get benefits of pension plan through EPF Employee Provident Fund. But what about those who are working in un-organized sectors, such as farmers, self-employed, business persons, workers, etc ?

Don’t worry friends the government is there for your help. They introduced the pension cum investment scheme known as Public Provident Fund or PPF. Its same as EPF. It’s a ideal Long term investment plan in debt category. Now every person can take benefit from this PPF scheme. And secure their future life. Or enjoy the post retirement life happily.

What is Public Provident Fund Scheme?

Public Provident Fund Scheme is a savings-cum-tax-saving instrument in India which is framed under the government Act of 1968. It is a long-range small saving scheme supported by the government to ensure that the unemployed residents and people who work in unorganized sector save for their retirement.

It is a form of retirement security fund provided for by the central government for the welfare of unemployed Indian residents. The main aim of PPF scheme is to encourage people save, however little the saving is, by making an investment worthwhile. This is achieved through reasonable return rates and income tax benefits

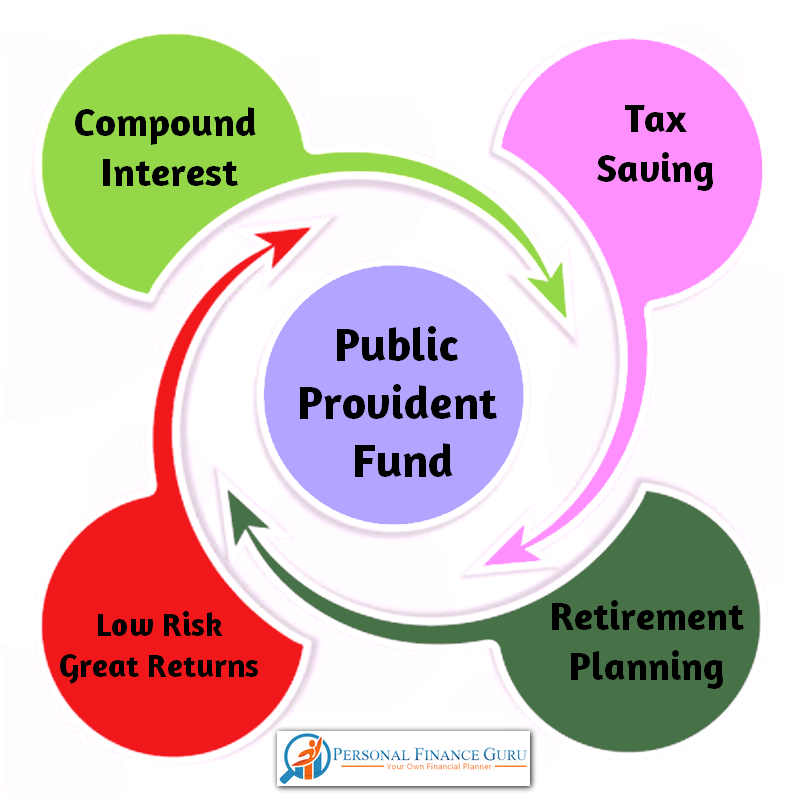

Benefits of PPF

Public Provident Fund – Benefits

- You can deposit up to Rs 1,50,000 in your PPF account.

- The amount deposited in PPF account is exempted from tax under 80C.

- Contribution to PPF account of spouse, children are also eligible for tax exemption.

- Interest earned is also Tax FREE.

- Balance of PPF accounts can not be attached to any debt or liability claim.

Eligibility for PPF account

- Indian residences are the ones supposed to benefit from the scheme.

- No non-Indian resident NRI is allowed to open an account. However, if a resident becomes a non-resident Indian during the PPF scheme prescribed tenure, their subscription to the fund may be continued until its maturity without a five-year extension possibility after maturity.

- Hindu divided family is not eligible for this scheme. This become effective on the 13th May of 2005. In case of an accounts that was opened before this date, the subscription to the fund continues until maturity. This too, does not have an expansion possibility after it matures.

An individual is allowed to maintain only one account, unless the other account is for a minor. This means that a parent can maintain their own account and the minor’s account, but only one parent is allowed to maintain the minor’s account. At no point should both father and mother open PPF accounts for the same minor.

Investment amount Limits for PPF account

- One need to deposit minimum Rs 500 per year in your PPF account.

- Maximum amount you can deposit is 1.5 Lakh per pear (as of 2015) earlier it was 1 Lakh, before that it was 70,000

- Deposit should be multiple of Rs 100

- You can deposit lump-sum amount or in instalments. But please note at max only 12 instalments are allowed.

- You can deposit amount by cash, cheque, Demand Draft(DD) or online transfer.

- Any amount exceeding the maximum amount cannot earn any interest and neither can it be rebate under the Income Tax Act. As the subscriber, you can choose to make a lump sum deposit or pay the deposit in installations, as long as you do not exceed 12 installments in a single year.

Duration of PPF account

- The scheme should last an original duration of 15 years for it to mature

- In case if you decides to extend this period, then you are allowed to but you need to first apply for an extension.

- The extension period should be a period of five years, whereby you can extend the original duration by one or more 5-year terms.

- PPF works on financial year basis (April 1st – March 31st) and interest is credited only at the end of financial year.

Interest on PPF account

- How much interest your money should earn is the sole decision of the Indian government. It decides on the rate of interest which is applicable to your PPF account.

- Currently, the interest rate is 8.70% compounded yearly. This has been the interest rate since 1st April 2013 which was preceded by a previous interest rate of 8.80%. Interest payments are made on the 31st day of March every year.

- PPF interest is calculated monthly on the lowest balance between the end of the 5th day and last day of month, however the total interest in the year is added back to PPF only at the year-end.

| Period | Interest Rate (p.a.) |

| 01 Dec 2011 – 31 March 2012 | 8.60% |

| 01 April 2012 – 31st March 2013 | 8.80% |

| 01 April 2013 – 31st March 2014 | 8.70% |

| 01 April 2014 – 31st March 2015 | 8.70% |

| 01 April 2015 – 31st March 2016 | 8.70% |

Tax Benefits under PPF account

The tax benefit is available on both invested amount and interest earned.

- The amount deposited in PPF account is exempted from tax under 80C.

- Contribution to PPF account of spouse, children are also eligible for tax exemption.

- Interest earned after maturity is also Tax FREE.

- 8% tax-free interest is effectively 12.85% pre-tax interest if you are in the 30% tax bracket and 11.25% if in the 20% tax bracket.

- Amount in PPF account is also exempt from Wealth Tax.

Liquidity/ loan on PPF account

Loan

- You can access loans between the 3rd and 5th financial year. The loan interest rate is supposed to be above the prevailing interest on PPF by 2% since the 1st of December, 2011. For loans that were borrowed before this came to pass, an interest rate of 1% more than the PPF interest per year continued to be charged until 30th of November 2013.

- You can borrow up to 25% of the balance of money in the account at the end of the second year.

- You are supposed to repay this loan within the next 3 years or 36 months.

- If you would want to borrow a second loan, ensure that the previous one is fully cleared and that you are still within your third financial year and 5th year.

- If you are doing your normal withdraws after the maturity period, you cannot access any loans.

- Accounts that have been rendered inactive and the ones that have been discontinued cannot also access this loan facility.

Maturity withdrawal

- The Public Provident Fund PPF- account has maturity period of 15 years. After this period you have below options available.

- Close the account and take whole tax free income earned.

- Within 1 year from date of expiry of 15 years, apply for extending PPF block period of 5 years.

If you applied for extension then you have to fill up the form H. it will also have 2 options:

- You can retain the PPF account without depositing any amount and still enjoy the interest.

- You can make deposits earlier.

- Complete withdrawal whereby one is allowed to withdraw 75% of the amount until they attain 58 years.

- Extension of the account without making further contributions. A default option which is activated automatically when an individual takes no step within one year after the fund matures. He or she does not apply for an extension and therefore does not make any additional payments to the matured fund. The subscriber can withdraw any amount of money as long as they withdraw only once in a single financial year. Money remaining in the account continues to earn interest.

- Extension of the account with contribution. The subscriber chooses to extend the account by making contributions. He or she is supposed to apply for an extension through the bank by submitting Form H within one year after the maturity of the fund. Only 60% of the amount of money in the account at the start of extension period can be withdrawn within the entire term of five years. Subscriber is allowed to make only one withdrawal each year.

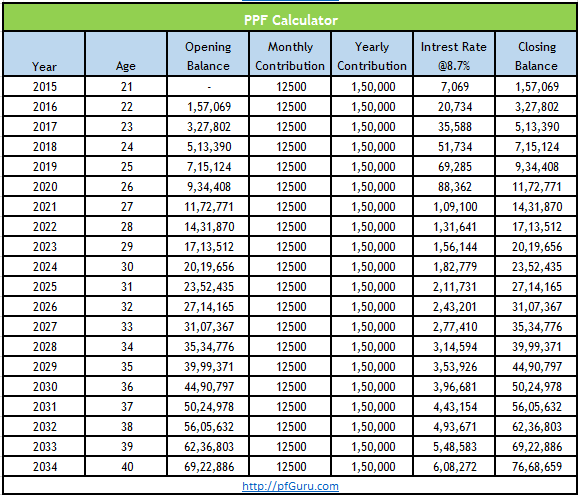

How much i can earn?

Public Provident Fund – PPF is the long term debt free investment scheme. It also has the power of compounding interest More you invest early, more return you get.

Eg. If you invest 1.5Lakh each year (before 5th April ) for next 15 years then with ROI of 8.7%, you will earn Huge sum of Rs 76,68,659

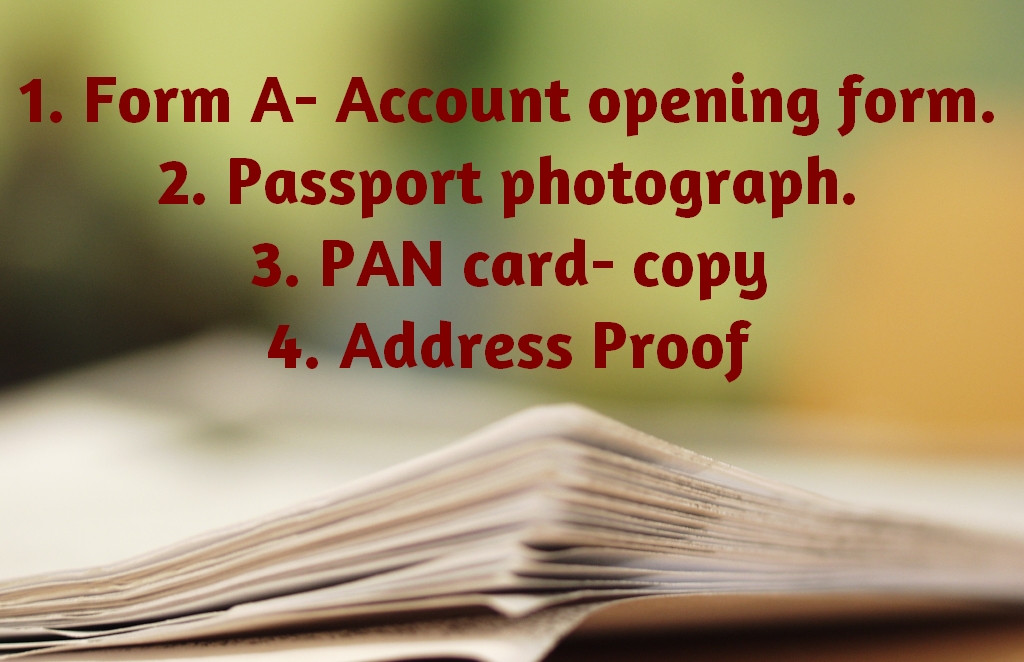

Documents required for account opening.

- Form A– Account opening form.

- A passport photograph.

- PAN card– copy

- A proof that you are an Indian resident. For example, it could a passport or electricity bill.

Nomination

The nomination is compulsory for PPF account. In case death of the account holder the nominee will get the accumulated amount. If balance in PPF account is more than 1 Lakh then Nominee has to provide identity and relevant documentation to claim the amount.

- A Subscriber may nominate one or more person.

- No nomination shall be made in respect of a/c opened on behalf of a minor.

- A nomination may be canceled or varied by a fresh nomination.

Where to open a PPF account

- If you want to open an account for the PPF scheme, you can visit either of the following

- State Bank of India branches and subsidiaries.

- Selected nationalized banks in India

- Designated post offices in the country.

List of Bank offering PPF account

YOU CAN NOT OPEN PPF ACCOUNT IN HDFC BANK.

PPF Forms

Sample forms from indiapost.gov.in in pdf format

| Form A | Application for opening a Public Provident Fund Account |

| Form C | Application for withdrawals |

| Form D | Application for a loan |

| Form E | Application for nomination |

| Form F | Application for cancellation/variation of nomination previously made |

| Form G | Application for withdrawal by nominees/legal heirs |

| Form H | Application for continuance of account beyond 15 years |

Deactivation and Reactivation of PPF account.

What will happen if I forgot to deposit the minimum subscription in one particular financial year

- Your account will be deactivated if you fail to deposit the minimum amount of Rs 500 in a year. To reactivate your account you will be required to pay some penalties.

- You will need to pay the Rs 500 minimum amount for every year you did not make deposits and a fine of Rs 50 for every skipped year. Once these payments are have been made, you money starts to earn interest again.

- Holders of deactivated accounts are not supposed to open another PPF account, the only option they have is to pay the penalties and continue with the revived account.

Transfer of PPF account to another bank branch or post office

- Only the authorized banks or post offices are involved. The subscriber should approach the bank or post office in which he has opened an account with and apply for a transfer of funds to an authorized bank or post office.

- His or her bank will then process the application and send it to the new bank the subscriber wishes to transfer the funds. The application is sent together with documents such as Form A, nomination form, certified copy of the account, your signature and a cheque for the outstanding balance in your account.

Risks

- It’s a Long term investment plan so money is blocked for 15 years.

- Rate of interest is not fixed. It may vary every year.

PPF account for NRI (Non Residential Indians)

- NRIs are not eligible to open fresh PPF account.

- The NRIs who already have PPF account when they are in India but become NRI during tenure of PPF are eligible to continue investment till maturity. But after maturity those funds should be used in India.

PPF calculator

Conclusion

Currently government is under inflammatory pressure. So we need to think twice before investing such long term investment schemes. As the ROI given by PPF is very less it cant fight with inflation.

Leave a Reply