The finance Minister of India Mr Arun Jaitley in his budget speech on 1st march 2015 said, “A large proportion of India’s population is without insurance of any kind, health, accidental or life. Worryingly, as our young population ages, it is also going to be pension-less. Encouraged by the success of the Pradhan Mantri Jan Dhan Yojana (PMJDY), I propose to work towards creating a universal social security system for all Indians that will ensure that no Indian citizen will have to worry about illness, accidents or penury in old age”

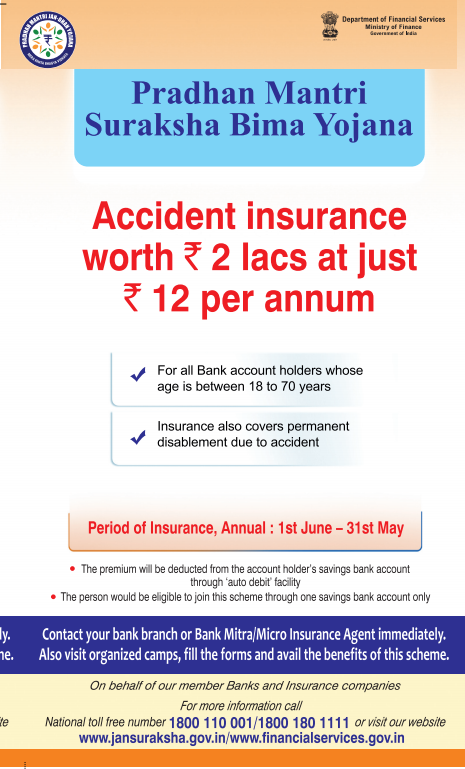

In India insurance has very deep-rooted history. It’s not new concept to India. But Its area of coverage is very less. Ie it failed to reach the masses. There are so many insurance companies operating in India with their vast majority of products and services. The majority (around 65%) population of India lives in rural area. And this major chunk of population is untouched from any kind of insurance coverage. This Pradhan Mantri Suraksha Bima Yojana is for them.

The majority people who are near / below poverty line can’t afford hefty insurance services. This Pradhan Mantri Suraksha Bima Yojana targets to reach such population with its benefited insurance schemes after the success of Pradhan mantra Jan Dhan Yojana.

Eligibility

- Age group of 18-70 years. Person should have completed 18 years of age and should not be elder than 70 years of age.

- Should have a saving bank account in any recognized bank.

- Should give consent letter of auto-debit facility. Its for the ease of account holder. He/she need not to transfer funds every year manually in this insurance plan.

Premium

This is very interesting that even poorest of poor can afford to pay the premium of PM Suraksha Bima Yojna. Its premium is ONLY Rs 12 per Annum Per Member.

The premium will be deducted from the account holder’s savings bank account through ‘auto debit’ facility in one installment on or before 1st June of each annual coverage period under the scheme. However, in cases where auto debit takes place after 1st June, the cover shall commence from the first day of the month following the auto debit.

Break-up:

- Insurance Premium-Rs.10 per annum per member.

- Reimbursement of expenses intermediaries like BC/Micro/Corporate/Agent-Rs.1 per annum per member.

- Administrative expenses to Bank for collecting the premium-Rs.1 per annum per member.

Mode of payment

There is only one mode of payment available, The premium is directly Auto debited by the bank from policy holder’s account.

Risk coverage/ Benefits of PM Suraksha Bima Yojana

- Accidental death : 2 Lakh

- Irrecoverable and total loss of both eyes or eye sight or loss of use of both hands or feet or loss of sight of one eye and loss of use of hand or foot : 2 Lakh.

- Partial disability, such as loss of one leg, hand, foot, eye or sight: 1 Lakh.

Scope of Coverage of Pradhan Mantri Suraksha Bima Yojna

- In case if you have multiple savings account, you are eligible to get only one insurance scheme attached to only one saving account.

- The primary KYC(Know your customer) document required for this policy is Aadhar Card.

- The premium is auto debited from linked saving bank account every year before 1st June.

Termination of cover under PM Suraksha Bima Yojana

Like all other policies in this policy also there is termination of policy functionality. In the following event of situation , the accident cover of policy holder would be immediately terminated and NO benefits would be paid thereafter.

- If policy holder attains age of 70 years.

- If the policy holder closes his/her saving account and/or is not able to continue with the premium paying process or minimum balance in the saving account.

- If the policy holder has opted for more than one policy under the scheme, the other policy except the oldest would be cancelled and terminated.

- If the premium was not paid due to insufficient balance in the saving account, the policy would be terminated till a period when the policy holder pays the premium.

Where to apply for this scheme

The PM Suraksha Bima Yojana will be available at all Public sector General Insurance Companies and all other insurers who which to join the this scheme and tie-up with bank for the same purpose. You can get application form from below link http://jansuraksha.gov.in/Files/PMSBY/English/ApplicationForm.pdf

See below FAQs no 12 and 13 for detail list.

Tax Benefits

The premium paid will be tax-free under section 80C and also the proceeds amount will get tax-exemption u/s 10(10D).But if the proceeds from insurance policy exceed Rs.1 lakh , TDS at the rate of 2% from the total proceeds if no Form 15G or Form 15H is submitted to the insurer.

How to claim

If policy holder passes away then the nominee has to inform the bank (within 30 days of accidental death, ) from which the insurance policy was taken.

You can get form for claim here http://jansuraksha.gov.in/Forms-PMSBY.aspx

On acceptance of the claim, the claim amount will be deposited in the bank account of nominee.

Documents to be Submitted in support of the Claim

- In case of Death: Original FIR/ Panchnama, Post Mortem Report and Death Certificate.

- In case of Permanent Disablement: Original FIR/ Panchnama and Disability Certificate from Civil Surgeon.

- Discharge voucher

FAQs

- Does tax payers are eligible for this scheme?

Answer: Yes, why not. tax payers are eligible and can get tax exemption under 80C

- Is it only for Poor people , who are under poverty line?

Answer: No. This scheme is available for all the people of India who fulfill the required criterion.

- Can eligible individuals who fail to join the scheme in the initial year join in subsequent years?

Answer: Yes, on payment of premium through auto-debit. New eligible entrants in future years can also join accordingly

- Can individuals who leave the scheme rejoin?

Answer: Individuals who exit the scheme at any point may re-join the scheme in future years by paying the annual premium, subject to conditions that may be laid down. - Who will be Mater policy holder?

Answer: The participating bank will be master policy holder

- I have personal accident cover and life insurance policy, can I opt for this policy and claim both?

Answer: Yes. You can claim for both policies. But note that insurance cover for PMSBY is only 2 lakh.

- Can I apply for both Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) & Pradhan Mantri Suraksha Bima Yojana (PMSBY) policy ?

Answer: Yes. You can enroll for both policies.

- I have multiple saving accounts, can I opt for multiple insurance policies?

Answer: NO. In case if you have multiple savings account, you are eligible to get only one insurance scheme attached to only one saving account.

You can have one type of insurance policy per saving bank account. So with same saving bank account you can take one Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) & one Pradhan Mantri Suraksha Bima Yojana (PMSBY).

One can also take Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) from 1 saving bank account & Pradhan Mantri Suraksha Bima Yojana (PMSBY) from other saving bank account.

- In case of death , does nominees have to pay premium?

Answer: NO. nominee would not have to pay the remaining premium. Under these policies if policy holder passes away, and has paid all due premiums till then, his/her nominee will get assured cover ie 2 lakh.

Please note if policy holder of Pradhan Mantri Suraksha Bima Yojna due to natural death, then nominee cant claim for assured cover.

- person with existing diseases such as critical illness covered under these scheme?

Answer: These schemes do not cover medical treatments for critical illnesses etc. These schemes cover death and/or accidental disability/death

- how to activate SMS based service in Hdfc bank pls tell me the SMS format?

Answer: “SMS PMSBY Y to 5676712″ – Be careful, by sending this SMS, you will be enrolled to this scheme i.e. PMSBY. Do it only if you want to subscribe to it.

- List of Insurance companies who offering Pradhan mantri Suraksha Bima Yojana

Answer:

- National Insurance,

- United India Insurance,

- ICICI Lombard,

- Cholamandalam MS,

- New India Assurance,

- Universal Sompo,

- Bajaj Allianz,

- Reliance General Insurance.

We shall be updating the tables as more information becomes available.

- List of Banks who offering PM Suraksha Bima Yojana

Answer:

| 1 | Allahabad Bank |

| 2 | Andhra Bank |

| 3 | Axis Bank |

| 4 | Bank of Baroda |

| 5 | Bank of India |

| 6 | Bank of Maharashtra |

| 7 | Bhartiya Mahila Bank |

| 8 | Canara Bank |

| 9 | Central Bank of India |

| 10 | City Union Bank Ltd |

| 11 | Corporation Bank |

| 12 | Dena Bank |

| 13 | Federal Bank Ltd |

| 14 | HDFC Bank Ltd |

| 15 | ICICI Bank Ltd |

| 16 | IDBI Bank Ltd |

| 17 | Indian Bank |

| 18 | Indian Overseas Bank |

| 19 | Induslnd Bank Ltd |

| 20 | Jammu & Kashmir Bank Ltd |

| 21 | Karur Vysya Bank Ltd |

| 22 | Kotak Mahindra Bank Ltd |

| 23 | Lakshmi Vilas Bank |

| 24 | Oriental Bank of Commerce |

| 25 | Punjab & Sind Bank |

| 26 | Punjab National Bank |

| 27 | Ratnakar Bank Ltd |

| 28 | South Indian Bank Ltd |

| 29 | State Bank of Bikaner & Jaipur |

| 30 | State Bank of Hyderabad |

| 31 | State Bank of India |

| 32 | State Bank of Mysore |

| 33 | State Bank of Patiala |

| 34 | State Bank of Travancore |

| 35 | Syndicate Bank |

| 36 | UCO Bank |

| 37 | Union Bank of India |

| 38 | United Bank of India |

| 39 | Vijaya Bank |

| 40 | Yes Bank Ltd |

| 41 | Rural Cooperative banks |

| 42 | Urban Cooperative Banks |

Contact details

The official website of these schemes is www.jansuraksha.gov.in. National Toll-Free – 1800-180-1111 / 1800-110-001 and State Wise Toll-free numbers are listed in this document Statewise Toll-Free.(PDF)

- Forms are available in Bangla,English Gujarati,Hindi,Kannada,Marathi,Odia,Tamil and Telugu which can be downloaded from jansuraksha.gov.in/forms.aspx

Conclusion

Hope we have cleared all your concerns about Pradhan Mantri Suraksha Bima Yojna (PMSBY). Even though we personally have enough Life and accidental insurance cover, but still we recommend you to enroll for this scheme. Contact your Bank for more details.

There are many people who are totally unaware of insurance due to not knowing the importance of insurance. I sincerely request all of you to spread this unique awareness and make them to be insured.

If you any questions related to Pradhan Mantri Suraksha Yojana then feel free to ask me in below comment box.

My wife has a saving bank account in State Bank of Patiala, Sector 7C, Chandigarh. She expired on 11.10.2015 in accident. She has subscribed Rs. 12/ in PMSBY and I am nominee. I have filled form for claiming Rs. 2 lacs but neither bank nor national insurance is doing anything. Both says different lines. What will i do and whre to approach ?

What if I fail to claim whitin 30 days