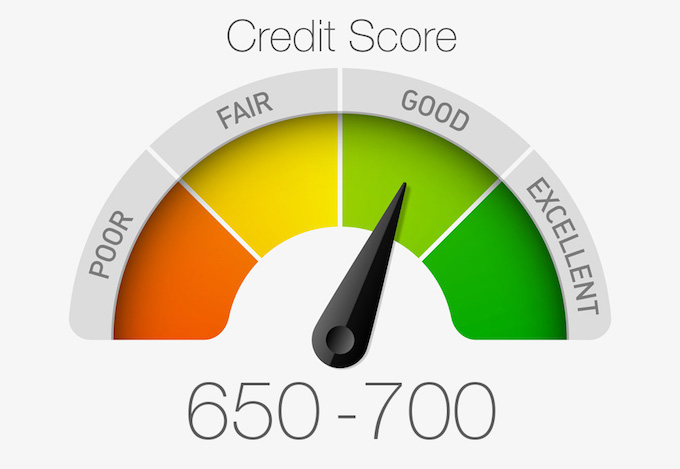

Your credit score has a profound effect in terms of the interest rate you will be paying when you apply for a loan. This is the basis that lenders use to determine if you will be able to pay for the amount in the future and if you need money to pay for college or renovate the home. It is good to know what it means to have a good credit score and how to improve credit score if you have a lower score.

Your credit score has a profound effect in terms of the interest rate you will be paying when you apply for a loan. This is the basis that lenders use to determine if you will be able to pay for the amount in the future and if you need money to pay for college or renovate the home. It is good to know what it means to have a good credit score and how to improve credit score if you have a lower score.

You see, when you apply for a loan, financial institutions and lending companies look at your credit score for guidance. People with low credit scores are more likely to be rejected for a loan or at best be given a small amount of a loan, with a high-interest rate and a shorter time frame to pay the loan.

In contrast, people with high credit scores are given higher amounts of money for a loan, lower interest rates, and longer time frame to pay the loan. This is because people with a good credit score are perceived as less of a risk, more responsible, more able to handle their finances and worthier to be given a loan.

Do you know, You can Remove Negative Items From Your Credit Report in 5 Simple Steps, YOURSELF!

Here are some tips that can help you improve your credit score.

1. Keep a payment schedule

one of the factors that affect credit score is your reputation for paying your bills. Even if you pay them, but always late, it can still affect your credit score. This is why it is important that you keep a payment schedule if you really want to raise your credit score a notch.

You can do this by keeping track of all your bills especially your credit card statements. This way, you will not only incur additional charges in terms interests, you will also build for yourself a good credit history.

2. Spend only when you need to

another factor that affects credit scores is your credit card. If you often have credit cards that are maxed out and well and beyond its credit limit, your credit score will become lower. This is because a maxed out credit card reflects a spender who cannot handle finances. This kind of person is a risky candidate for a loan.

3. Borrow from only one

some people make the mistake of applying for a loan in more than one company all at the same time. Do not do this. Although banks do not actually check with each other, they do have their own ways of finding out if you have also borrowed money from other institutions. If this is the case, your credit score will take a nosedive.

This is because people who borrow from a lot of companies are seen as too desperate for money or is too needful of it. Some see this as a dubious way of acquiring money. So if you are afraid of getting rejected and you just want to make sure that you will get a loan, try waiting for one response before starting an application in another. That way, your credit score will not suffer.

4. Pay your outstanding debts

you may be paying your debts but you have a lot that you are not finished paying yet. This is also not good in your credit history. Although most companies would want to lend you the money because you are a good payer, having too many outstanding debts that you are still paying for may make them think if you can still manage to pay another one.

5. Create Positive Entries on Your Credit Report

it is vitally important that you build positive credit in order to truly achieve the credit score you deserve. Further without building credit, even if you remove all the negative items from your credit history, you still will not get an excellent credit score.

It is said that your credit score will benefit the most from a revolving credit line such as an unsecured credit card. If you already have an unsecured credit card then you should try and keep your monthly balance at about 30% of your credit limit.

For example, if you have a credit limit of $1,000 then you should try to keep your monthly balance at about $300. This will show that you are using your credit and using it responsibly because your credit card is not maxed out.

Additionally, by having $700 of unused credit you will be helping your utilization ratio also known as your credit to debt ratio. This is an incredibly important piece of information when your credit score gets calculated. You can still get a good credit score with a lot of debt as long as you have a sizable amount of unused and available credit.

6. Remove Incorrect Items from Your Credit Report

you are entitled by the Fair Credit Reporting Act, a federal law, to dispute any item on your current report that you feel is incorrect. You can file a dispute for an item because the account is older than seven years, the account is paid, not my account, incorrect balance, the wrong dates…

The Fair Credit Reporting Act also states that the credit bureaus must be able to verify any information they have on your credit report with the lender or collection agency that reported the information to the bureau. When you file a credit report dispute you are requesting that the bureau verifies the account information on your credit report with the lender or collection agency.

7. Respect your credit.

The simple fact is that credit is a privilege, not a right. Creditors are not obligated to extend credit to you, and it can be revoked if you choose to abuse it. Failing to treat your creditors with respect and meeting your obligations will only lead to a bad credit score. Limit the amount of credit you use, pay off all accounts in a timely manner, and always remember to be grateful for the credit you have been granted.

If the credit bureaus are unable to verify your information then they must remove the bad credit from your credit report. As this article demonstrates, you no longer have to be plagued by nightmares about your credit score. Your credit situation can be turned around and you will finally have peace of mind about it. By the time you finish applying these tips, your credit score will be on its way up.

Best Credit Repair Company: SkyBlue Credit Repair

- Sign up for Sky Blue here | Sky Blue website | TOLL-FREE No (888) 596-6306 talk to live person for discount

great feedback.

You also need to avoid applying for multiple credit cards at the same time because it can hurt your credit score.