Atal-Pension-Yojana

Atal Pension Yojana ( APY ) was launched by Government of India. This scheme was launched along with 2 other insurance schemes i.e. Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) and Pradhan Mantri Suraksha Bima Yojana (PMSBY). Atal Pension Yojana is a social security scheme.

The income security at old age of the working poor is focused and encouraged by government of India. And helping to save for their retirement. Government started new pension scheme called ‘Atal Pension Yojana’ ( APY ) for the people who are in unorganized sector. This helps them to voluntarily save for their retirement. The scheme is administered by the Pension Fund Regulatory and Development Authority (PFRDA) through NPS architecture.

An account needs to be opened under Atal Pension Yojna and monthly contribution has to be made till the time of retirement of the subscriber. After that a pension ranging from Rs 1000 to Rs 5,000 per month would be paid to account holder. On death of subscriber and spouse the nominee will get the lump sum amount.

What is Pension? Why one need it?

A Pension provides people with a monthly income when they are no longer earning.

Need for Pension:

- Decreased income earning potential with age.

- The rise of nuclear family-Migration of earning members.

- Rise in cost of living.

- Increased longevity.

Assured monthly income ensures dignified life in old age

What is Atal Pension Yojana?

Atal Pension Yojana (APY), is a pension scheme for citizens of India focused on the unorganized sector workers. Under the APY, guaranteed minimum pension of Rs. 1,000/-, 2,000/-, 3,000/-, 4,000 and 5,000/- per month will be given at the age of 60 years depending on the contributions by the subscribers.

Government contribution

To make this scheme more attractive government

- Government would co-contribute 50% of the subscriber’s contribution or Rs. 1000 per annum, whichever is lower. Government co-contribution is available for those who are not covered by any Statutory Social Security Schemes and is not income tax payer. It Means if you are an Employee Provident Fund (EPF) subscriber then you will not be eligible for government co-contribution part.

- Government will co-contribute to each eligible subscriber, for a period of 5 years who joins the scheme between the period 1 st June, 2015 to 31 st December, 2015. The benefit of five years of government Co-contribution under APY would not exceed 5 years for all subscribers including migrated Swavalamban beneficiaries.

- All bank account holders may join APY.

Atal Pension Yojna

Eligibility

Any Citizen of India can join Atal Pension Yojana ( APY ) scheme. The following are the eligibility criteria,

- The age of the subscriber should be between 18 – 40 years.

- He / She should have a savings bank account/ open a savings bank account.

- The prospective applicant should be in possession of mobile number and its details are to be furnished to the bank during registration.

How to Apply for Atal Pension Yojana ?

- Go to the bank in which you have opened your savings bank account, eg SBI, Axis, PNB, HDFC, etc.

- Fill up the Atal Pension yojna registration form. You can download form from Here. http://www.jansuraksha.gov.in/forms.aspx

- Provide you Aadhar and Mobile number if you have. Its not mandatory BUT Aadhaar would be the primary KYC document for identification of beneficiaries, spouse and nominees to avoid pension rights and entitlement related disputes in the long-term.

- Provide details of your nominee. Its compulsory.

- Keep sufficient funds in that savings account for the transfer of monthly contribution.

Any Tax benefits under Atal Pension Yojna ?

No. There are no tax benefits on contribution to Atal Pension Yojana. Many people might think that they will get exemption under 80 C or on maturity, but no benefits are available. The pension you get is considered as Income from salary and would be used in tax computation.

Who will not receive government co-contribution?

Beneficiaries who are covered under statutory social security schemes are not eligible to receive Government co-contribution. For example, members of the Social Security Schemes under the following enactments would not be eligible to receive Government co-contribution:

- Employees’ Provident Fund & Miscellaneous Provision Act, 1952.

- The Coal Mines Provident Fund and Miscellaneous Provision Act, 1948.

- Assam Tea Plantation Provident Fund and Miscellaneous Provision, 1955.

- Seamens’ Provident Fund Act, 1966.

- Jammu Kashmir Employees’ Provident Fund & Miscellaneous Provision Act,1961.

- Any other statutory social security scheme.

If you have an EPF account then you will not receive any contribution from government. You have to make full contribution by yourself.

Is Aadhar number is mandatory to join Atal Pension Yojana?

It is not mandatory to provide Aadhaar number for opening APY account. However, For enrollment, Aadhaar would be the primary KYC document for identification of beneficiaries, spouse and nominees to avoid pension rights and entitlement related disputes in the long-term.

Mode of payment

All the contributions are to made monthly through auto-debit facility from your savings bank account. So manually you cant submit money in atal pension yojana scheme.

Can I apply for this scheme without savings bank account?

For joining APY savings bank ac is mandatory.

What will happen if required or sufficient amount is not maintained in the savings bank account for contribution on the due date?

Non-maintenance of required balance in the savings bank account for contribution on the specified date will be considered as default. Banks are required to collect additional amount for delayed payments, such amount will vary from minimum Re 1 per month to Rs 10 per month as shown below:

- 1 per month for contribution upto Rs. 100 per month.

- 2 per month for contribution upto Rs. 101 to 500 per month.

- Re 5 per month for contribution between Rs 501 to 1000 per month.

- Rs 10 per month for contribution beyond Rs 1001 per month.

Discontinuation of payments of contribution amount shall lead to following:

- After 6 months account will be frozen.

- After 12 months account will be deactivated.

- After 24 months account will be closed.

Subscriber should ensure that the Bank account to be funded enough for auto debit of contribution amount. The fixed amount of interest/penalty will remain as part of the pension corpus of the subscriber.

How much should I contribute to Atal Pension Yojana?

It depends on the age if the person and how much pension Rs 1000, 2000, 3000, 4000 5000 you wants. Please Note that once a person dies the spouse(Husband/ wife) will get pension and after death of spouse nominees will get lump sum amount.

See samples:

| Age of Joining | Years of Contribution | Monthly contribution |

| 18 | 42 | 42 |

| 20 | 40 | 50 |

| 25 | 35 | 76 |

| 30 | 30 | 116 |

| 35 | 25 | 181 |

| 40 | 20 | 291 |

Is there an option to increase or decrease the monthly contribution for higher or lower pension amount?

The subscribers can opt to decrease or increase pension amount during the course of accumulation phase, as per the available monthly pension amounts. However, the switching option shall be provided once in year during the month of April.

What is the withdrawal procedure of Atal Pension Yojana?

- On attaining the age of 60 years:

The exit from APY is permitted at the age with 100% annuitisation of pension wealth. On exit, pension would be available to the subscriber.

- In case of death of the Subscriber due to any cause:

In case of death of subscriber pension would be available to the spouse and on the death of both of them (subscriber and spouse), the pension corpus would be returned to his nominee.

- Exit Before the age of 60 Years:

The Exit before age 60 would be permitted only in exceptional circumstances, i.e., in the event of the death of beneficiary or terminal disease.

How to know the status of my contribution?

The status of contributions will be intimated to the registered mobile number of the subscriber by way of periodical SMS alerts. The Subscriber will also be receiving physical Statement of Account.

What will happen to existing subscribers in Swavalamban Yojana?

The existing Swavalamban scheme may be automatically migrated to Atal Pension Yojana.

For age of subscriber between 18-40 yrs:

All the registered subscribers under Swavalamban Yojana aged between 18-40 yrs will be automatically migrated to APY with an option to opt out. However, the benefit of five years of Government Co-contribution under APY would be available only to the extent availed by the Swavalamban subscriber already. This would imply that if, as a Swavalamban beneficiary, he has received the benefit of government Co-Contribution of 1 year, then the Government co-contribution under APY would be available only for 4 years and so on.

Existing Swavalamban beneficiaries opting out from the proposed APY will be given Government co-contribution till 2016-17, if eligible, and the NPS Swavalamban continued till such people attain the age of exit under that scheme.

Other subscribers above 40 years who do not wish to continue may opt out of the scheme with lump sum withdrawal. Subscribers above 40 years may also opt to continue till the age of 60 years and eligible for annuities.

Lumpsum Corpus that Nominee will receive

On death of person who was member of Atal Pension Yojna and his spouse(wife/husband), the nominees will receive a lump-sump amount shown in table below. The amount received will be based on how much monthly pension had the person who joined Atal Pension Yojna chose. For example if person chose Rs 2000 of Monthly pension amount, the lump-sump amount received will be Rs 3.4 lakh. If person chose Rs 5000 as monthly pension amount the nominee will receive Rs 8.5 lakh.

| Monthly Pension Amount (Rs) | Corpus (Rs) |

| 1000 | 1.7 lakh or 1,70,000 |

| 2000 | 3.4 lakh or 3,40,000 |

| 3000 | 5.1 lakh or 5,10,000 |

| 4000 | 6.8 lakh or 6,80,000 |

| 5000 | 8.5 lakh or 8,50,000 |

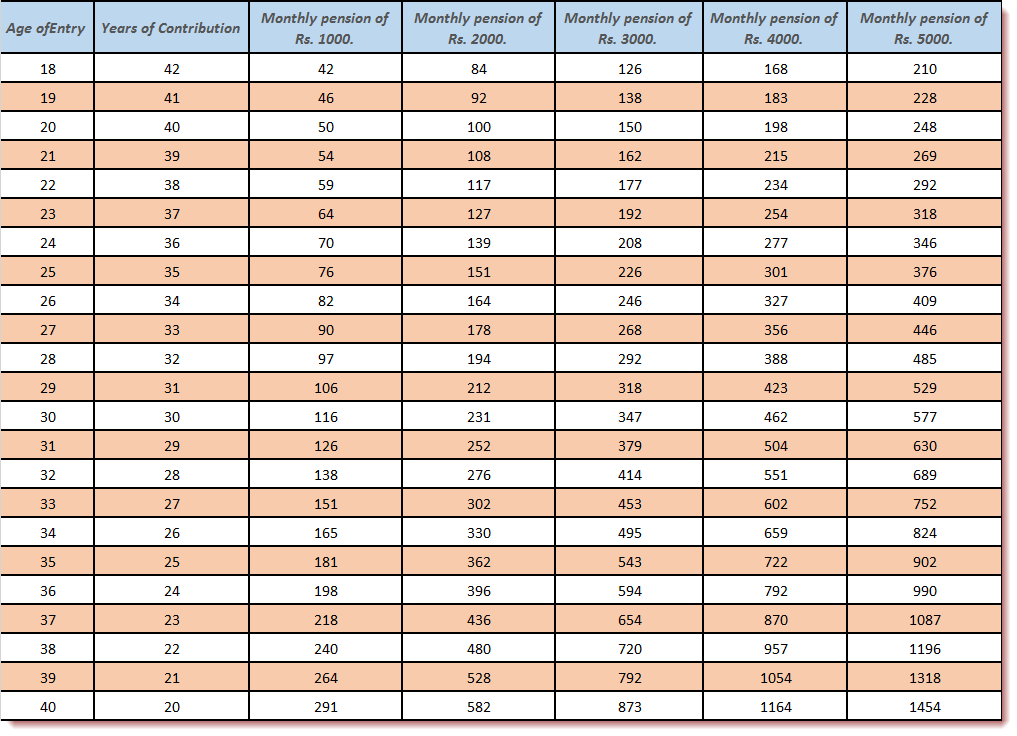

Age wise Atal Pension Yojna Contribution Chart

The amount that one has to contribute for monthly pension of Rs 1000, Rs 2000, 3000, 4000 & 5000 at ages between 18-40 is given below.

Atal Pension Yojana chart

Concern : Inflation

Although the pension of Rs 5000 may sound good today. But what will be the price of these Rs 5000 after 20-35 years? This pension scheme have not considered the inflation. Due to this inflation factor the price of todays 5000 Rs will much less in future. So there should be mechanism to adjust contribution and pension amount in order to fight inflation in future.

Should I invest?

I will leave this upto you. I would like to state that this scheme is more for the people who have poor background and who have not access to social security scheme. This scheme is not so beneficial for tax payers. As you are not going to get any contribution from government side. If you wants to still apply for Atal Pension Yojana account, you should find a good enough reason for yourself.

Contact details:

The official website of the scheme is www.jansuraksha.gov.in . National Toll-Free – 1800-180-1111 / 1800-110-001 and StateWise Toll free number are listed in this document Statewise Toll-Free (pdf)

Administered by:

Pension Fund Regulatory and Development Authority,

1 st Floor, ICADR Building, Plot No. 6, Vasant Kunj

Institutional Area, Phase‐II, New Delhi‐110070

[…] Atal Pension Yojana (APY)is a Pension Scheme for unorganized sector workers. […]