If you own a working telephone then chances are you receive at least a few calls every year from insurance sales agents. They all sound so convincing and can make you feel like that not buying insurance is the most irresponsible thing you have ever done.

Even the TV ads are oriented towards making you feel guilty about not getting insurance. It’s time you realized the truth. Insurance policies are not different from any other products that you can buy off the shelf or order online. Buying or not buying insurance is your choice, which should be based on your particular need.

It’s somewhat like buying ice cream. If your fridge is stocked up on desserts and other sweet goodies it may not make sense going out just buy a new tub. However, if you are craving something sweet and there is nothing remotely sugary inside the fridge then it’s certainly a good idea to go out and stock up on some ice cream.

Similarly, if you already have a good financial plan for the future and have healthy savings to take on almost any turmoil then buying insurance may just prove to be a waste.

On the flip side of the coin, if you cannot bear the cost of unforeseen events such as medical emergencies, car accidents, or just want to leave behind a substantial sum for your loved ones at the time of your death then buying insurance is surely the way to go. To help you understand whether you need insurance or not let’s first cover the basics.

WHAT IS INSURANCE?

Insurance helps customers financially safeguard themselves from a particular risk. According to the terms of the policy, insurance companies pay out fully or partly when that particular risk becomes real.

For example, if you have a health insurance, the company would typically pay your hospital bills and other medical expenses if you get hospitalized. It’s not just medical, you can buy insurance for almost anything you want.

Soccer star Cristiano Ronaldo has insured his legs for a whopping $144 million. That just goes to show that insurance should always be need based. If for some unforeseen reasons Cristiano lost his legs his income from soccer would stop almost immediately and that $144 million payout will help financially sustain his lifestyle.For anyone else it may sound ridiculous but for him the insurance policy makes perfect sense.

How does Insurance companies work?

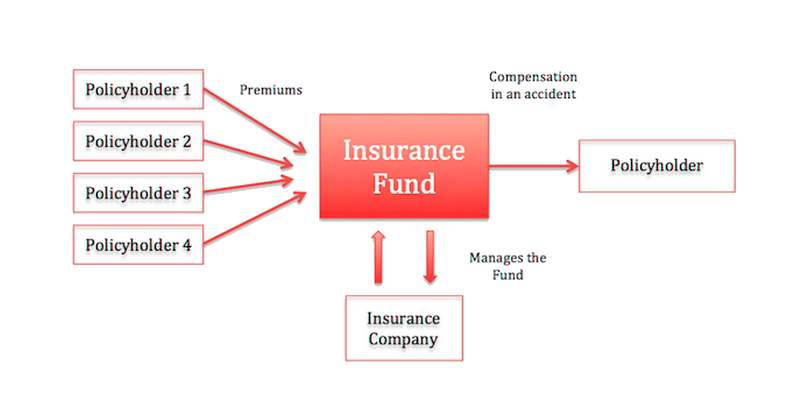

Once you buy a particular insurance you agree to pay premiums after regular intervals. As long as you are paying the premium you are covered by the policy. Now the premium paid by you and millions of other customers to the insurance company gets accumulated and gathers interest.

Now, when the company needs to pay out all they have to do is reach into that financial bucket. Considering the fact that there is always a steady flow of premiums coming in and there are comparatively far lesser instances that fulfill the conditions for payouts that financial bucket keeps gathering more and more money.

Sounds a bit complicated? Following is a simple example that will help you understand the inner workings of an insurance company.

Consider the example of 10 friends. Each of them has houses in different locations. Now to safeguard their real estate investment against natural disasters, all 10 of them buy a property insurance offered by a particular insurance company. They all pay a yearly sum to the insurance company.

Now this money keeps on accumulating and gathers interest over the years. When one of those houses is hit by an earthquake the insurance company takes some of the accumulated money and pays out to repair the damages.

In other words, the 10 friends are financially safeguarding each other’s houses and the insurance company is just a mediator who manages the funds.

HOW DOES INSURANCE COMPANIES PROFIT?

The first thing you should realize is that insurance companies are out to make a profit and are not charitable institutions. The way they turn a profit each year even after paying out millions of dollars to the customers is by betting on statistics.

Insurance companies hire experienced analysts and statisticians to calculate the probability of a particular event for which they need to pay out. These analysts gather information from the customer before approving any policy. They feed that information into sophisticated software to calculate the likelihood of a claim.

Now as the probability of the claim increases the insurance company also increases the premium amount. This how they make sure that there is right amount money flowing in as premiums to cover all the claims and still maintain a substantial profit.

TYPES OF INSURANCES:

Even though there are several subtypes, insurance can be broadly categorized into 2 divisions. Those are life insurance and general insurance. Let’s take a look at each of them to understand what they offer.

Life Insurance:

As the name suggests, life insurance involves paying pre-defined beneficiaries upon the death of the insured individual. Simply put this is an insurance that helps financially protect your loved once you are gone.

General Insurance:

This is a blanket term that covers all insurances that do not fall under the life insurance category. General insurance includes health insurances, fire insurances, travel insurances, auto insurances, and various others. Simply put these insurance financially protects your assets and the health of you and your loved ones.

Questions You Need to Ask Before Buying Any Insurance

When it comes to buying an insurance policy don’t just base your decision on the sales pitches delivered by the insurance agents. Be prepared to do your own research before signing the dotted lines. Following are 3 questions you need to ask yourself before buying an insurance policy

Do I Need This Policy?

This is the fundamental question that you need to ask yourself before anything else. Buying an insurance is a long term commitment and if you don’t particularly need it’s always better to invest that money into mediums that will give you secured returns.

Do I Fully Understand The Policy Terms?

A lot of people commit the mistake of not reading the policy terms. This is a big mistake as based on these terms your claim can easily get rejected when are you in dire need of financial aid. Read the policy terms carefully and don’t shy away from seeking help from a lawyer if you need them explained.

What Is The Insurance Company’s Claim Settlement History?

Even though the insurance industry is highly regulated and monitored by independent agencies, it’s always a good idea to check out the claim settlement history of insurance companies. Insurance companies often publicly declare their insurance claim ratio on their websites.

This ratio basically tells you how much percentage of the total claims has been settled by the company. Anything above 80% is considered to be healthy.

That’s a really interesting way to look at it that an insurance provider is the mediator between all the people who have insurance. I got a new house, and I was wondering who I should get covered by. I’ll have to look around for the best provider I can.