Know your PAN

PAN or Permanent Account Number, is the Unique 10 digit alphanumeric number given to all Indian Tax payers by Income Tax Department of India under the supervision of Central Board for Direct taxes.

The PAN is mandatory for many major financial transactions, such as receiving taxable salary, opening bank account, sale or purchase of assets above specified , buy equity, mutual funds, etc.

The main purpose of PAN is to have Universal Identification to all financial transactions and prevent tax evasion by keeping track of your high value transactions.

The PAN is Unique for each individual and it’s allotted for lifetime of holder, throughout India. Once issued, the PAN is not affected by change of address or location of holder

Structure & provisions

The card is issued under Section 139A of Income tax act. It’s a 10 digit alpha-numeric code.

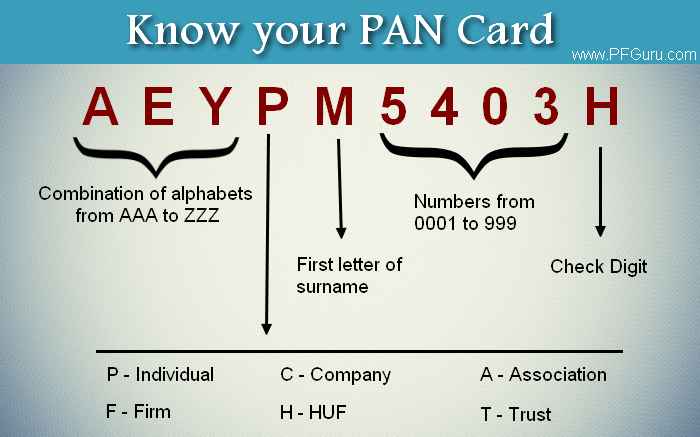

A typical PAN is AEYPM5403H

- First five characters are letters, next four are numerals and last character is letter. First 3 letters are combination of alphabets from AAA to ZZZ. Fourth character inform about holder of card. As follows:

A — Association of Persons (AOP)

B — Body of Individuals (BOI)

C — Company

F — Firm

G — Government

H — HUF (Hindu Undivided Family)

L — Local Authority

J — Artificial Judicial Person

P — Individual

T — AOP (Trust)

2. The fifth character of the PAN is the first character

(a) of the surname or last name of the person, in the case of a “Personal” PAN card, where the fourth character is “P” or

(b) of the name of the Entity, Trust, society, or organisation in the case of Company/ HUF/ Firm/ AOP/ BOI/ Local Authority/ Artificial Judicial Person/ Govt, where the fourth character is “C”, “H”, “F”, “A”, “T”, “B”, “L”, “J”, “G”.

3. The last character is an alphabetic check digit.

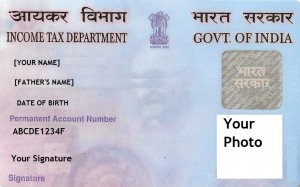

- PAN card bears a facial picture of the holder, the date of birth, the date of issue and a hologram sticker, which acts as an additional security feature.

- PAN cards for minors, issued through UTI-ITSL do not bear photo nor the date of issue.

A typical PAN card looks like below image.

Sample PAN Card

-

Why should I get PAN number? / Uses of PAN number

You should have a PAN because for many financial transactions it’s mandatory. Eg. its used for

- Payment of Direct taxes.

- To file ITR (Income tax Returns)

- Sale or purchase of property valued above Rs 5 lakh.

- Sale or purchase of vehicle other than 2 wheeler.

- Payment to hotels/ restaurants of amount more than 25 thousands.

- Payment of amount Rs 50 thousand or more to RBI bonds.

- Fixed deposits of Rs 50,000 or more amount.

- Any mutual fund purchase.

- Deposit exceeding Rs 50thousand in any bank within 24 hours.

- Purchase of foreign currency.

- Any communication with income tax department.

-

How to Apply ?

Obtaining PAN is optional and voluntary like passport, driving license, Aadhar etc but its mandatory for high value transaction as mentioned above.

In order to get PAN number in India you have to visit Income Tax Department through their TIN facilitation centers. You can visit the TIN facilitation center near to your location. These agencies are authorised by NSDL (Income tax department).

You can also apply online, by using online services of NSDL .

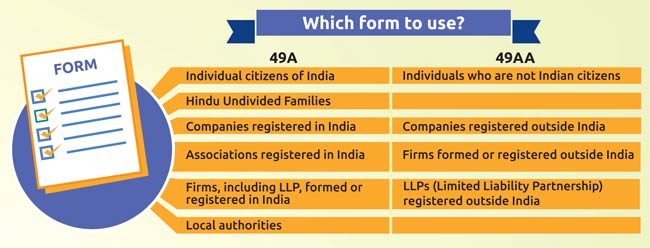

To Apply online you need to visit https://tin.tin.nsdl.com/pan/ . Use either ‘Form 49A’ or ‘Form 49AA’ whichever applicable to you. You can get more info about these forms from below image.

Form 49A or Form 49AA

On successful submission of online application and payment (for online mode of payment), an acknowledgement receipt is generated. Save and take a print out of the acknowledgement receipt.

The duly signed and photos affixed acknowledgement receipt along with prescribed supporting documents (for cheque/DD mode of payment) should be sent to:

NSDL at 5th Floor Mantri Sterling ,

Plot No. 341, Survey No. 997/8, Model Colony,

Near Deep Bungalow Chowk,

Pune-411 016.

- The 15 digit acknowledgement no. appearing on the acknowledgement receipt can be used for tracking status of application. Mention the 15 digit acknowledgement number on top of envelop as “Application for PAN – <Your acknowledgement number>” (e.g. ‘APPLICATION FOR PAN – 881010100000097’).

If you don’t want to apply online then to get PAN you need to visit TIN facilitation center or UTI approved center of the district. Along with 2 recent passport size color photographs, ID proof, Address proof, Date of Birth proof and fees.

Application Fees

- For dispatch of PAN card within India Rs 106 ( Rs 94+14% service tax)

- For dispatch of PAN card outside India Rs 985 [ (Application feeRs 93.00 + Dispatch Charges 771.00) + 14% service tax]

Mode of Payment

For dispatch of PAN card within India

- Credit Card / Debit Card

- Net-banking

- Cheque / Demand draft drawn in favour of ‘NSDL-PAN’ payable at Mumbai.

For dispatch of PAN card outside India

- Credit Card / Debit Card

- Demand draft drawn in favour of ‘NSDL-PAN’ payable at Mumbai.

If you are not available then you can appoint someone to make payment on behalf of you. Persons authorized to make Credit card / Debit card / Net banking payment are as below:

| Category of Applicant | Payment by Credit Card / Debit Card / Net Banking can be made by / for |

| Individual | Self, immediate family members (parents, spouse, children) |

| HUF | Karta of the HUF |

| Company | Any Director of the Company |

| Partnership Firm / Limited Liability Partnership | Any Partner of the Firm / Limited Liability Partnership |

| Association of Person(s) / Body of Individuals / Trust / Artificial Juridical Person / Local Authority | Authorized Signatory covered under section 140 of Income Tax Act, 1961 |

- Please note that, additional amount of 2% will be charged if you are making payment through credit or debit card. If mode of payment is net banking then 4%+ service tax will be charged.

If you are applying for PAN through TIN facilitation center then you need to pay extra charges other than the PAN fees.

AO Codes

It is mandatory for the applicants to mention the AO code in the PAN application. The AO code under jurisdiction of which the applicant falls, should be selected by the applicant. The applicants are advised to be careful in selection of the AO code.

Supporting Documents

- Proof of Identity (POI), Proof of Address (POA) and Proof of Date of Birth (PODB)

- Proof of AADHAAR (Copy of AADHAAR Card), if AADHAAR is mentioned.

The most common reason for rejecting your application form is, name mismatch. The name appearing on address proof and ID proof must match.

Additional documents for PAN Change Request application

- Proof of PAN – Copy of PAN card/allotment letter

- Proof of Change Requested – Documents indicating change of name (i.e. Name/Father’s name) from old name to new name

Signature/ Thumb impression

Signature / Left Thumb Impression should only be within the box provided in the acknowledgement. The signature should not be on the photograph affixed on right side of the form. In case of applicants other than ‘Individuals’, the authorized signatory shall sign the acknowledgement and affix the appropriate seal or stamp. The signature should NOT be on photograph. If there is any mark on photograph such that it hinders the clear visibility of the face of the applicant, the application will not be accepted.

Thumb impression, if used, should be attested by a Magistrate or a Notary Public or a Gazetted Officer under official seal and stamp.

Photograph

‘Individual’ applicants should affix two recent colour photographs with white background (size 3.5 cm x 2.5 cm) in the space provided in the acknowledgement

Status check

You can know the status of you PAN card by entering acknowledgement number or name of concern person with his/her birth date. You can check status of your PAN here.

Also you can get the status of your application through SMS.

Type NDSLPAN<space>acknowledgement number and send it to 57575. You will get immediate reply with your PAN status..

- It will take about 10-15 days to receive the card, it is sent by courier / registered India Post.

PAN card for NRIs

If you are NRI then you can also apply for PAN number, process is slightly different from above. As a NRI you need to fill the form 49AA. If you are qualified investor then you have to apply through Depository Participant.

Applicants who are –

- Citizen of India but residing out of India at the time of making application.

- Not a citizen of India i.e. foreign citizen.

- Other than individual (like company or trust or firm etc.) – not a citizen of India – having no office of its own in India.

PAN Card is required by an NRI, if he/she has got a taxable income in India.

- According to the new, rule of SEBI ,any NRI not having PAN card cannot do the share trading by depository or broker.

- PAN is also mandatory for an NRI, if he/she would like to invest in Mutual Funds

- If you don’t want to trade but want to purchase some land or other property in India then also it is mandatory to have PAN card issued by Government of India

To apply for PAN card please visit https://tin.tin.nsdl.com/pan/

Corrections/ changes in PAN details

The procedure for correction in Pan details, is same as new PAN, Only you have to submit your PAN card copy and correction of details in the form. you can apply for changes/ corrections in PAN details here.

Do’s

- Fill the application using Black ink. And do not forget to do so in BLOCK LETTERS..

- Do the signature in the given box and not over the photograph.

- Make sure that you are providing correct AO code.

- Do write the complete postal address in the application with landmark.

- Do mention correct pin code in the address field.

- do mention correct phone number and email ID.

Don’ts

- It is not advisable to overwrite or to make corrections in the given application.

- Do not attach photographs to application by means of pin or staple.

- While making signature, do not write date or place underneath the sign.

- Do not mention Husband’s name in the Father’s Name column.

- Last but not the least; Please do not apply for the PAN card if you already have one.

Warning:

While the alphanumeric PAN number is unique, individuals and corporate entities have been able to obtain multiple PAN cards fraudulently. It is illegal to obtain multiple PANs and there is a penalty of Rs.10,000/- when caught.

For more information :

– Call PAN/TDS Call Centre at 020 – 27218080; Fax: 020 – 27218081

– e-mail us at: tininfo@nsdl.co.in mailto:tininfo@nsdl.co.in

– SMS NSDLPAN <space> Acknowledgement No. & send to 57575 to obtain application status.

– Write to:

INCOME TAX PAN SERVICES UNIT (Managed by NSDL e-Governance Infrastructure Limited), 5th floor, Mantri Sterling, Plot No. 341, Survey No. 997/8, Model Colony, Near Deep Bungalow Chowk, Pune – 411016

If you have any queries related with PAN card then feel free to ask it in below comment box. Subscribe to our site for the latest tips about personal finance.

Great! very detail post. Thanks.