Life insurance is a critical aspect of financial planning. In other words, it’s creating provisions for family members when you aren’t around for life. The insurance cover ensures financial security for your loved ones – which includes your kids, spouse and parents. Life insurance may not be the most cordial topic to have a conversation on. But when you sit down with an insurance expert, going over the details, you realize there cannot be anything more important you could do for your family members.

Why is Life Insurance Important?

Life insurance basically remits funds to family members (beneficiaries) once the insurance cover owner deceases. The following are the reasons why life insurance is important:

- The cover reduces your family’s financial burden post your death, which includes your kids’ education expenses and the debts you’ve left behind, if any. It pays for your estate taxes and funeral expenses.

- It offers mortgage protection, ensuring your spouse and other dependents don’t go homeless post your untimely death.

- Life insurance serves as pension income replacement.

Basics of Life Insurance

Life insurance isn’t an investment, contrary to what most people believe it to be. The insurance plan is a pool of invested funds, which accumulates interest with time. The insurance firm accrues interest by investing those funds for commercial gains, similar to banks, and pays you a specific portion of the interest earned via your money. A life insurance cover is often offered by employers, but some people (sole proprietors, business professionals, etc.) purchase their insurance cover through an agent.

For policy eligibility, you must go through a medical test that helps the insurance firm determine your blood-sugar and cholesterol levels. Your hobbies, medical history, driving record, credit rating, etc. are also inspected. Your policy premium amount could drive up based on factors like age, past health issues, lifestyle habits, etc.

The Insurance Options Available

a) Whole Life Insurance

This life insurance plan offers guaranteed insurance cover for the insured’s entire life, also called permanent coverage. The policy carries a “cash value” element, which grows tax-free at a predetermined amount till the contract gets surrendered. The premium is uniform throughout the insured’s life and the death advantage is pledged for the lifetime of the insured.

b) Universal Life Insurance

Also known as adjustable life or flexible premium insurance, universal life insurance differentiates from a whole life plan. Its term and cash benefits are identical to whole life, but it distinguishes in the aspects of cash values, premiums, and protection level. Cash values make an interest amount periodically set by the insurance firm and are usually guaranteed to not fall below a specific level.

c) Variable Life Insurance

This insurance policy entails two distinct elements: separate account and general account. The separate account comprises multiple investment funds that are part of the firm’s portfolio – equity fund, bond fund, money market fund, etc. General account, on the other hand, is the insurance provider’s liability or reserve account, not assigned to a specific policy. Due to this feature, the death benefit and cash value could fluctuate, therefore the name “variable”.

d) Variable Universal Life Insurance

Variable universal amalgamates the aspects of universal and variable life policies and offers the consumer flexibility pertaining to adjusting death benefits, premiums, and investment choice selection. Technically categorized as securities, this insurance type is subject to SEC regulation. The entire investment risk rests with the owner of the policy; the death advantage value could fall or rise based on the policy investments’ success.

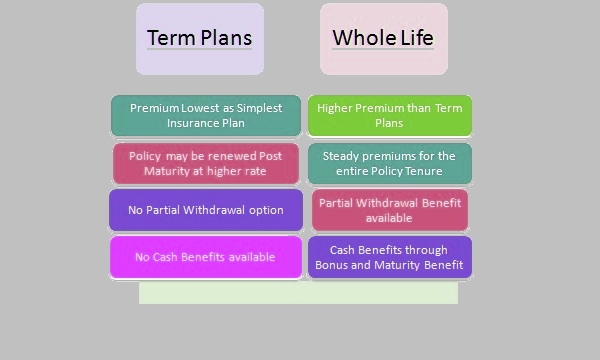

e) Term Life Insurance

Term life insurance is among the most common policies. The insurance could safeguard your beneficiaries against monetary loss as a result of your demise; it pays out the policy’s face amount, but only offers safety for a specific, but limited time period. The maximum policy period is 30 years and it doesn’t create cash values. These policies are beneficial when the time required for protection and the money for coverage are limited. The policy’s premiums are substantially lower when compared to whole life costs.

Endowment or Money-Back Covers

The confusion pertaining to selecting insurance covers often boils down to endowment policies and money-back plans. With endowment, your beneficiaries receive money when you decease during the policy term. In case of no death, you receive the invested money at the end of the plan. Money-back plans, on the contrary, offer payments at regular intervals. For instance, you’ll receive 10 percentage of the policy amount after a couple of years and another 10 percent after two more years, and so forth. The actual percentage and interval gap varies across policies.

Both the policies are for predetermined terms. Mortgage plans can also be used as securities for obtaining a loan, which is not possible with a money-back plan. This is because money-back plan’s portions get deducted constantly.

Term Insurance Policies

A term insurance policy is the ideal insurance form as it offers a higher cover for a lower price. In fact, the premium payable is only a fraction of the amount that’s payable when you purchase a money-back policy or endowment plan. This structure is because the plan doesn’t comprise an investment element. The whole premium is for risk coverage.

Term insurance covers cost less, especially when compared to whole life covers. But the insurance may remain valid only for a few predetermined years.

Recommended Life Insurance Sum

You must approach things structurally with a life insurance plan. Your life scenario is a good measure of how much your insurance cover must be worth. The number of family members dependent on your income must be taken into account. For instance, reserve the maximum possible amount if you’re married, have children, and old parents to take care of. If it’s just your spouse and kids, or only your better half, the insurance plan’s total worth can be reduced accordingly.

Your overall financial strength is also a key variable. If you’d like to leave behind a considerable sum for your family after your death, you can opt to do so, without taking the above factors into consideration.

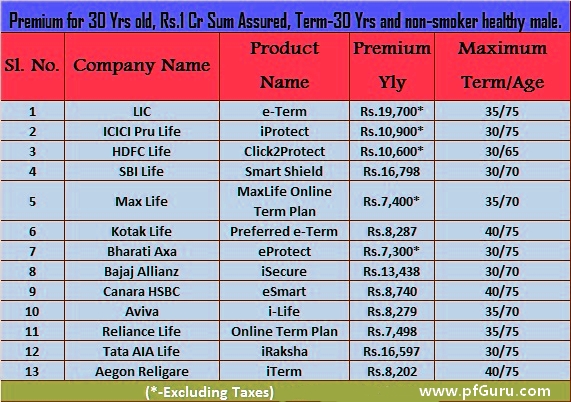

Below are the Best available Term insurance plans:

Best Term Insurance Plans 2015

Conclusion

A life insurance is not always an imperative expenditure, at least in the case of a few individuals. If you don’t have any dependents and have sufficient assets to make up for your debts and dying costs (funeral, fees of estate lawyer, etc.), then a life insurance is an unnecessary burden. At the same time, if your financial wealth is enough to provide for your dependents post your demise, life insurance still doesn’t make the cut. The insurance’s relevance pops up only when your assets are outweighed by your debts, and with dependents around.

It’s nice that you pointed out how life insurance could reduce your family’s financial burden post your death. I was chatting with some of my friend’s last night and one of them recommended that I should take a life insurance. It seems pretty handy to have it, so maybe I should contact an insurance agency later.