Sukanya Samriddhi Yojana

Sukanya Samriddhi Yojana or Girl child Prosperity scheme is the part of ‘Beti Bachao, Beti Padhao’ campaign. It’s a special deposit scheme launced by our prome minister Narenda modi on 22nd January 2015 for a girl child. Main purpose of this Sukanya Samriddhi Yojna is to provide girl education and her marriage expenses. As we know in our country for many people think Girl child as a burden to the parents. They think we require too much money (Pls read Dowry ) for the marriage of the Daughter so why to spend on her education? This is really very sick mentality but its also the truth in many towns.

With this Sukanya Samridhi Yojana government is trying to convince the parents that don’t worry about your daughter’s education or marriage. Just educate her. We will give the best scheme to you for to save for her education and marriage.

Complete details of Sukanya Samriddhi Yojana. In this article we have covered all major aspects related to this Sukanya Samriddhi account and the FAQs. Find Everything you want to Know About Sukanya Samridhi Account. Check complete details for Sukanya Samridhi Yojana from Below.

Under Sukanya Samriddhi Yojana an account can be opened by parents or legal guardian of a girl child of Less than 10 years age with min deposit of Rs 1000 in any post office or authorized bank. The interest of 9.1% is provide on such deposits and its exempted from tax under section 80C.

The Sukanya Samriddhi account is remain active for the 21 years from the date of opening the account or till the marriage of the girl child . Parents can withdrawal partially up to 50% of the account balance in order to fulfill the education expenses of the girl till she attains age of 18 years.

Eligibility

- This scheme is only for girl child

- Age of Girl child should be under 10 years. (Birth to 10 years.) if the child turned 10 any time between December 2013 and December 2014 ie born between Dec 2003 to 2004, you can still open account in her name as this scheme was announced on Jan 2015.

- Only natural or legal guardian can open one account in her name.

- One can open Sukanya Samridhi account for the Girl child born after December 2003.

- Its allowed to open one account each for two girl child.

For third Girl child:

Under this scheme natural or legal guardian of the girl child shall be allowed to open third account in the event of birth of twin girls as second birth or if the first birth itself results into three girl children, on production of a certificate to this effect from the competent medical authorities where the birth of such twin or triple girl children takes place.

Benefits of Sukanya Samridhi Yojana ( SSY )

- SSA offers the highest rate of interest at the rate of 9.2% for financial year 2015-16. No other small saving schemes could match Sukanya Samriddhi scheme

- With this scheme you can save taxes completely along with securing a good future for the girl child

- Investment with a lock-in period

- A great social initiative to secure the future of girl child in India

- Maturity proceeds would only be paid to the girl child and no one else

- Even after maturity of the account, if the account-holder wishes to continue the account, the same ROI would apply to the account.

- Very easy processes to operate Sukanya Samriddhi Account is one of the key benefit.

Maximum , Minimum deposit

Initial deposit for Sukanya samriddhi account is Rs 1000/- and then multiple of Rs 100.

- Minimum deposit is Rs 1000 per year, failure to this will cost penalty of Rs 50.

- Maximum deposit is Rs 1.5 Lakh per year.

Mode of payment

The deposit should be done by Cash or cheque or Demand Draft (DD), No online transfer or No auto deduction.

Maturity

Parent or guardian of the girl child can deposit only 14 years from the date of opening the account. From 14 years to 21 years they can not deposit any amount but government will give interest on accumulated amount till maturity of the account.

The maturity of the Sukanya samriddhi account is 21 years from the date of opening account or if the girl gets married before completion of such 21 years.

- If girl gets married before completion of 21 years, then the operation on sukanya samridhi yojana account is not allowed. The account automatically gets closed.

- In case if the death of girl child occurred before maturity, the account will be closed immediately and the balance will be deposited to the guardian’s account.

Interest Rate

- Under this sukanya samriddhi yojna account ROI is not fixed by government, it will vary every year just like other govt schemes PPF, NSC.

- Rate of interest paid for the financial year 2015-16 is 9.2%.

- The interest is compounded yearly and will get credited to account automatically till the maturity.

- The interest earned is also tax free.

Interest calculator

The method of calculation of interest for Sukanya Samriddhi yojana is same as Public Provident Fund( PPF). So if you deposit maximum amount in initial years then you will get maximum benefits. Also if you deposit at the start of the month (1st to 5th ) of the month then you will get m ore benefits.

Eg.

- Deposited Rs 1000 in start of every month – you get Rs 6,07,128.

- Deposited Rs 12,000 in april every year – you get Rs 6,31,261 (Difference is Rs 24, 133)

More the contribution more will be the difference.

- Deposited Rs 10,000 in start of every month – you get Rs 60,71,283

- Deposited Rs 1,20,000 in April every year – you get Rs 63,12,607 (Difference is Rs 2,41,324 )

You can download our Sukanya Samriddhi yojana calculator from below link.

Sukanya Samriddhi Yojana Calculator.

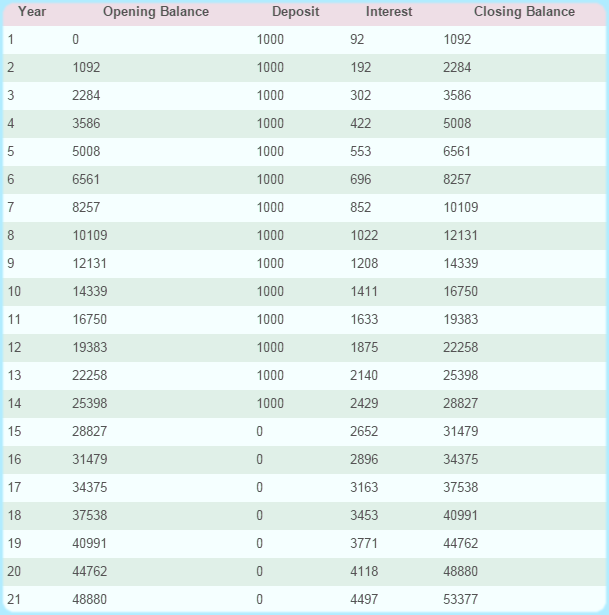

If you deposited Rs 1000 per year , and Rate of interest is 9.2 % then at maturity your amount in sukanya samriddhi yojana account will be Rs 53,377.

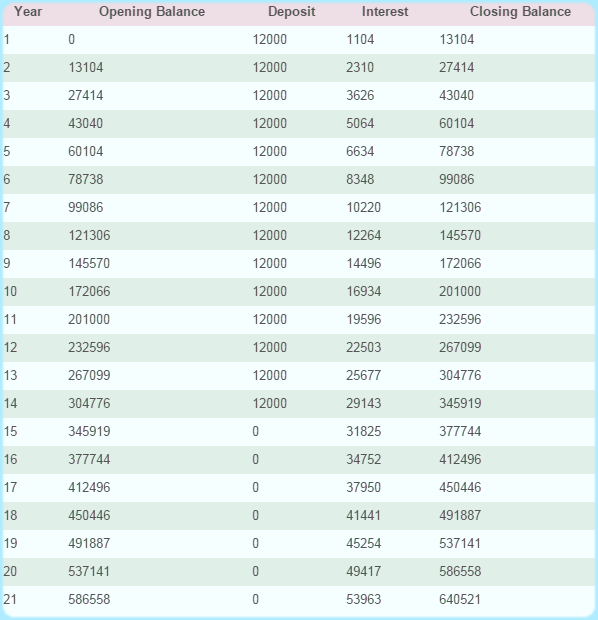

If you deposited Rs 12000 per year , and Rate of interest is 9.2 % then at maturity your amount in sukanya samriddhi yojana account will be Rs 6,40,521

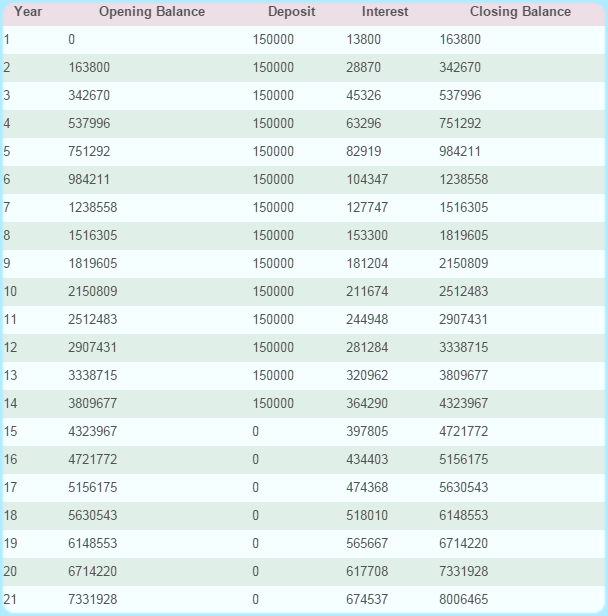

If you deposited Rs 1,50,000 per year ie the Maximum allowed amount, and Rate of interest is 9.2 % then at maturity your amount in sukanya samriddhi yojana account will be Rs 80,06,465

Tax benefits under Sukanya Samriddhi Yojana

As we have stated sukanya samridhi yojana is just like PPF, so the amount deposited under this scheme is exempted under section 80 C. its upper limit is Rs 1.5 Lakh.

- No tax on interest earned.

- No tax on maturity amount.

Premature Closure of account

(1) In the event of death of the account holder, the account shall be closed immediately on production of death certificate issued by the competent authority, and the balance at the credit of the account shall be paid along with interest till the month preceding the month of premature closure of the account , to the guardian of the account holder.

(2) Where the Central Government is satisfied that operation or continuation of the account is causing undue hardship to the account holder, it may, by order, for reasons to be recorded in writing, allow pre-mature closure of the account only in cases of extreme compassionate grounds such as medical support in life-threatening diseases, death, etc.

Premature withdrawal

(1) To meet the financial requirements of the account holder for the purpose of higher education and marriage, withdrawal up to 50% . of the balance at the credit, at the end of preceding financial year shall be allowed.

(2) The withdrawal referred to in sub-rule (1) shall be allowed only when the account holder girl child attains the age of eighteen years.

Closure on maturity

- The account shall mature on completion of twenty-one years from the date of opening of the account :

– Provided that where the marriage of the account holder takes place before completion of such period of twenty one years, the operation of the account shall not be permitted beyond the date of her marriage :

– Provided further that where the account is closed under the first proviso, the account holder shall have to give an affidavit to the effect that she is not less than eighteen years of age as on the date of closing of account.

2. On maturity, the balance including interest outstanding in the account shall be payable to the account holder on production of withdrawal slip along with the pass book.

3. If the account is not closed in accordance with the provisions of sub-rule (1), interest as per the provisions of rule 7 shall be payable on the balance in the account till final closure of the account.

Where to open the account?

The parent or guardian of the girl child can open the sukanya samriddhi yojana account in any post office or government approved bank.

You can download the account opening from here https://rbidocs.rbi.org.in/rdocs/content/pdfs/494SSAC110315_A3.pdf

- Number of deposits either in a month or in a financial year (just like saving bank account).

Nomination

- Nomination is NOT allowed in sukanya samriddhi yojna.

What in case of death of Girl child or the depositor in SSA Yojana?

- In case of death of the depositor:

- The account would get closed and deactivated, and

- The balance amount along with interest accrued would be refunded to the parent or legal guardian, whoever is the depositor.

In condition of death of the parent (Father or Mother) or the legal guardian and if the family feels that there is no one else to make the deposits further, there could be two possibilities:

- The total amount along with interest accrued would be refunded to the girl child or her family, or

- The total balance amount may not be refunded, but kept in the account until the amount matures and no fresh contributions would be required. The balance left in the account would keep growing with interest and thus would in turn the girl child at the time or her higher studies or marriage.

The details of the above mentioned scenarios can be discussed by the authorized personnel at the branches dealing in this account.

Documents Required

- Birth certification of girl child in whose name account shall be opened.

- Address proof of parent or guardian of the girl child.

- ID proof of parents.

- Two photographs of parents/ legal guardian

List of Bank

|

1 |

Allahabad Bank |

|

2 |

Andhra Bank |

|

3 |

Axis Bank Ltd |

|

4 |

Bank of Baroda |

|

5 |

Bank of India |

|

6 |

Bank of Maharashtra |

|

7 |

Canara Bank |

|

8 |

Central Bank of India |

|

9 |

Corporation Bank |

|

10 |

Dena Bank |

|

11 |

ICICI Bank Ltd |

|

12 |

IDBI Bank Ltd |

|

13 |

Indian Bank |

|

14 |

Indian Overseas Bank |

|

15 |

Oriental Bank of Commerce |

|

16 |

Punjab & Sind Bank |

|

17 |

Punjab National Bank |

|

18 |

State Bank of Bikaner & Jaipur |

|

19 |

State Bank of Hyderabad |

|

20 |

State Bank of India |

|

21 |

State Bank of Mysore |

|

22 |

State Bank of Patiala |

|

23 |

State Bank of Travancore |

|

24 |

Syndicate Bank |

|

25 |

UCO Bank |

|

26 |

Union Bank of India |

|

27 |

United Bank of India |

|

28 |

Vijaya Bank |

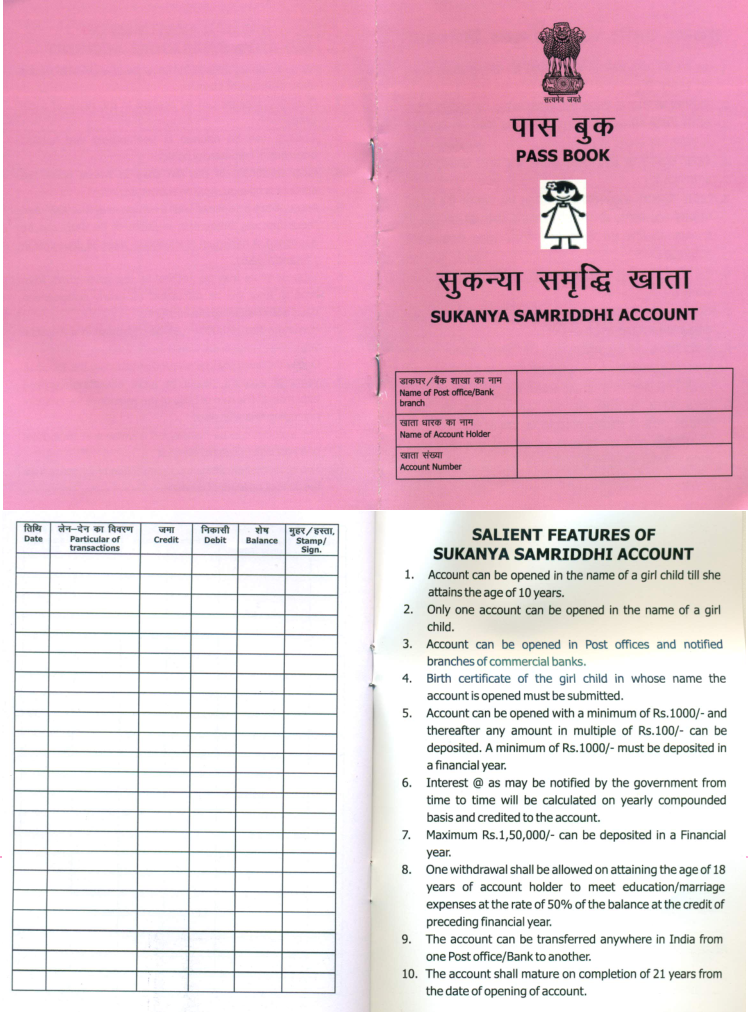

How does the Sukanya Samriddhi Yojana passbook looks like?

Can NRI parent open the Sukanya Samriddhi Yojna account?

Sukanya Samriddhi Yojna is governed by Post office Small Savings Scheme rules and NRIs are not eligible to invest in such schemes. But in the official gazette, there is no clause about NRI’s eligibility. It’s also not clear whether one opens the account and then becomes NRI will one have to close the account or it can be continued till maturity as in PPF. But remember that one has to physically go and pay the amount.

Drawbacks of SSY Account

- No fixed rate of interest:The scheme offers a great interest rate of 9.2% per annum for FY 2015-16, which happens to be the best among all other small saving schemes; however, the ROI is not fixed for the entire tenure. It may keep varying every year with market trends and that may or may not be as decent as the current one.

- Premature withdrawal not allowed:A lot of people who are not financially secure have a habbit of using whatever money they have in the time of crisis. Since, there is a long lock-in period associated with the account; such kind of parents would not really be interested in operating Sukanya Samriddhi Account. Read more for Premature Withdrawal.

- High lock-in period of 21 years:The lock in period is a little on higher side for those who are looking for a shorter investment options. The mature proceeds could only be withdrawn either at the time of marriage of the girl child or for the purpose of higher education of girl child. 21 years of lock-in period may not go well with some people.

- No online transfer facility:This is one of the major drawbacks of the scheme. We wonder how the government and policy makers could oversee the possibilities of online banking to be applied on this scheme. Today, when every thing is being done over internet, making this scheme a non-online subject will add to the discomfort of account holders and increase the work pressure on bank and post office branches.

I have covered almost all aspects of Sukanya Samriddhi Yojana SSY . If still you have any questions then please feel free to ask in below comment box.

hii,

sukanya samriddhi yojana is a part of ‘Beti Bacao Beti Padao Yojana’ Sukanya Samriddhi Account of the girl child by a parent or guardian in the name of his birth will be opened up to the age of ten. this investment funds plan for their young lady tyke.

it is a best plan for girl child and the most important thing is availability, it is available in most of the bank very easily. you give good information about it.

Its very nice sceam for girls.