Atal Pension Yojana (APY)is a Pension Scheme for unorganized sector workers. Min and Max age of entry under Atal Pension Yojana is 18 years and 40 years. Pension will start at the age of 60 years. Premature withdrawal is allowed only in case of a death of a beneficiary or terminal disease. Depending on the contribution of […]

Importance of Life Insurance

Life insurance is a critical aspect of financial planning. In other words, it’s creating provisions for family members when you aren’t around for life. The insurance cover ensures financial security for your loved ones – which includes your kids, spouse and parents. Life insurance may not be the most cordial topic to have a conversation […]

Atal Pension Yojana – All you wants to Know.

Atal Pension Yojana ( APY ) was launched by Government of India. This scheme was launched along with 2 other insurance schemes i.e. Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) and Pradhan Mantri Suraksha Bima Yojana (PMSBY). Atal Pension Yojana is a social security scheme. The income security at old age of the working poor […]

Difference between Pradhan Mantri Suraksha Bima Yojana (PMSBY) & Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY)

Indian government have taking very good initiative for the security of middle and poor class families, by introducing policies like Pradhan Mantri Suraksha Bima Yojana (PMSBY)( (for Accidental Death and Disability)) & Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) (for life insurance) Many people have confusion about these two policies. So for the simplicity of […]

Pradhan Mantri Jeevan Jyoti Bima Yojana – Benefits, How to Apply guide

Life insurance was never the favorite topic of Indian people. It was not available / affordable for masses. The new government trying hard to have insurance coverage for all the people of India by introducing various schemes. In last article we have discussed Pradhan Mantri Suraksha Bima Yojana (PMSBY) in details, […]

Detail guide about Pradhan Mantri Suraksha Bima Yojana (PMSBY)

The finance Minister of India Mr Arun Jaitley in his budget speech on 1st march 2015 said, “A large proportion of India’s population is without insurance of any kind, health, accidental or life. Worryingly, as our young population ages, it is also going to be pension-less. Encouraged by the success of […]

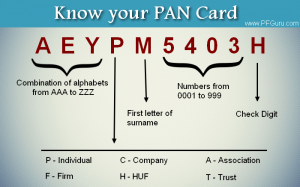

Everything you need to know about PAN (Permanent Account Number) Card

PAN or Permanent Account Number, is the Unique 10 digit alphanumeric number given to all Indian Tax payers by Income Tax Department of India under the supervision of Central Board for Direct taxes. The PAN is mandatory for many major financial transactions, such as receiving taxable salary, opening bank account, sale or purchase of assets […]